To look at some of the recent economic data, one would think the consumer is in great shape.

The U.S. economy—70 percent of which is driven by consumer spending—grew 4.2 percent last quarter, even better than the originally reported 4.0 percent growth in GDP. The report, issued Thursday, also showed consumer spending rose 2.5 percent in the quarter, contributing 1.69 percentage points to overall GDP gain.

However, a read from corporate America paints a very different picture of consumer spending in the second quarter. Comments from executives this earnings season from companies spanning the retail, food, beverage, restaurant and staples industries portray a "challenged" state of the U.S. consumer.

"In North America, the overall retail environment in our category remained challenging, with soft traffic and permanent promotion in a retail environment throughout most of the second quarter," said Paul Marciano, vice chairman and CEO of Guess?.

"The challenging macroeconomic environment," said Mark Buthman, chief financial officer of Kimberly-Clark, the maker of Kleenex tissue and Huggies diapers.

"Low- and middle-end consumers are continuing to struggle. They have changed their buying habits. Data now suggest that out of necessity, many folks have reduced their overall consumption, and absolute unit growth across Nielsen-measured channel data supports this. While our customer always finds a way to work through difficult times, she is struggling to overcome the sustained nature of the headwinds she is facing," said Richard Dreiling, chairman and CEO of retailer Dollar General.

"A challenging retail environment," said Kurt L. Darrow, CEO of La-Z-Boy.

"I think it's pretty apparent that the low- to moderate-income customer is struggling. ... So I don't think we have anything to add to that other than I think that that customer is challenged economically and finding this environment difficult," said Michael B. O'Sullivan, president and chief operating officer of Ross Stores.

"In a continuing challenging environment," said Mike Jeffries, Abercrombie & Fitch's CEO.

"Our outlook for the fall season reflects our confident optimism tempered with the reality that many customers still are feeling the impact of an economic environment that at best is improving very gradually," said Karen Hoguet, chief financial officer of Macy's.

"The North American consumer picture continues to be weak, with retail sales among the top 30 food and beverage manufacturers roughly flat in the quarter," said PepsiCo CEO Indra Nooyi.

"It looks like low-income consumers are purchasing less. They are going less in the store and to fight this, the environment is very promotional. This is something that we see clearly in the U.S. but not only, we have seen this phenomenon also in Europe," said Michele Scannavini, CEO of cosmetics and fragrance company Coty.

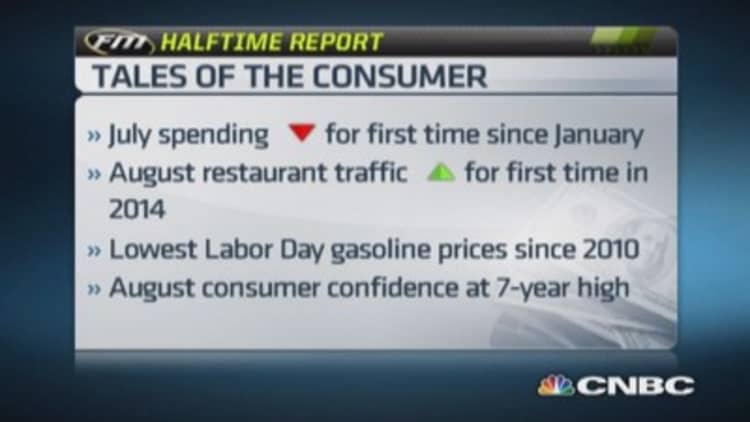

There is some support for all this gloom in the latest read from the Commerce Department on consumer spending, which unexpectedly fell in July as savings rose to its highest level in more than 1½ years—a sign of consumer caution.

Read MoreConsumers snap wallets shut as income growth slows

The question is: Going forward, does this cast doubt on those stronger growth forecasts for the remainder of the year?

There are reasons for optimism. In August, consumer confidence surged to the highest level since 2007, according to the Conference Board. And those rosier feelings were echoed in a read on consumer sentiment released Friday by Thomson Reuters and the University of Michigan.

Read MoreUS confidence rose in August, shaking off doubts

Prices at the pump have been steadily falling with the price of oil, making for the cheapest gasoline on a Labor Day weekend since 2010.

In the month ended Aug. 10, restaurant traffic turned positive for the first time all year, with the number of people eating out up 0.3 percent, according to GuestMetrics.

Read MoreLess bad is good enough for teen retail—for now

Consumer Edge Research's State of the U.S. Consumer report, which looks at net sales growth from U.S. divisions of 38 public consumer-facing companies showed momentum in August.

"Unlike the previous months, where the majority of consumer strength was seen almost exclusively among the high-income group, the low-income group showed a nice pickup in August, due to moderating gas prices," according to the Consumer Edge report.

—By CNBC's Sara Eisen