This week, Jim Cramer found that the averages reached a very bizarre moment. Overseas drama from Europe and China found a way to rebound on to U.S. shores in a positive way, because it means that interest rates may not rise anytime soon.

However, global weakness is bad news for international companies' earnings, and could stir worries of a worldwide recession.

"It's a world turned ugly, where we don't know a winner from a loser unless it reports outstandingly fabulous or terrible earnings," the "Mad Money" host said.

And as ridiculous as it may sound, Cramer smells some serious profits that could be made next week—but only when investors buy on the dips that are unrelated to the U.S. economy.

With this in mind, Cramer outlined his list of stocks that he will be watching next week:

Monday: Estee Lauder, Urban Outfitters

Estee Lauder: This stock has quietly become one of the best performing worldwide packaged goods companies out there. So while it might seem absurd to own shares of a company that trades at 30 times earnings, it makes sense to Cramer, because Estee Lauder has a history of posting upside surprises.

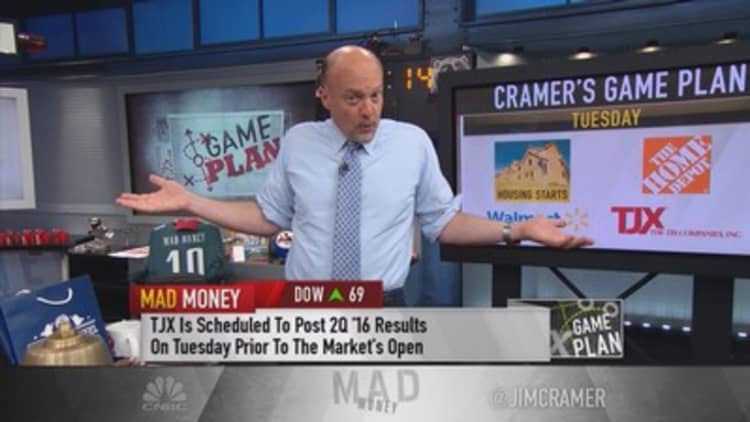

Tuesday: Housing starts, Home Depot, Wal-Mart, TJX Companies

Housing Starts: Tuesday brings a report on housing starts in the U.S. and Cramer thinks we could see a good number. Renting has become the most expensive versus owning for the first time in ages. That means investors will figure out that housing is in bull market mode (because there's more value in owning a home), and Cramer thinks Toll Brother and Lennar are the cheapest way to play it.

Wal-Mart: This company is a principal beneficiary of China's currency devaluation because it buys so many goods there. Cramer thinks it could be a buy if the quarter is decent, but wants to hear what it has to say first.

"I think the turn here is a long one, and Doug McMillon, the new CEO is trying to shake things up, but turning Wal-Mart around is like turning around 10 battleships," Cramer said.

Wednesday: Lowe's, Target, Hormel, Salesforce

Target: Its recent stock lag means that it's primed for disappointment. Cramer said to way for it to report, and if it breaks down to the 3 percent yield, buy it.

Hormel: Cramer loves its acquisition of Applegate Farms that made this brand more natural and organic, and thinks it could have a great quarter.

Salesforce: While the stock hasn't done much lately, in Cramer's experience it is a good idea to buy the stock ahead of Dreamforce, which takes place in September.

Read more from Mad Money with Jim Cramer

Cramer Remix: China is totally crushing this stock

Cramer: Heavy-hitter stocks running with the bulls

Howard Schultz: Business leaders must do more

Friday: Deere, Foot Locker

Deere: The farm equipment business has been horrible lately, but Deere has remained strong. So while crop prices have gone down recently, Cramer is not intrigued by the terrific manufacturer with an expensive stock price.

Foot Locker: Cramer anticipates that there will be an event next week that will drive this stock lower. Considering that it's the cheapest of stocks that are priced for perfection, he thinks it could be the best trade of the week. But only buy it on a dip.

"We've got some topflight companies reporting next week, including the best of the domestic retailers. I smell profits, but only if you buy on dips unrelated to the U.S. economy," Cramer said.

That logic might not make sense, but then again, the market sometimes doesn't make sense either.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com