As biotechnology shares cratered on continued criticism from presidential candidates about rising drug prices, one hedge fund has managed to find eye-popping returns in the space.

While the iShares Nasdaq Biotechnology ETF saw an 11 percent gain in 2015, the Perceptive Life Sciences Fund posted a 51.8 percent return and was the No. 1 performing hedge fund of last year, according to a Bloomberg News ranking.

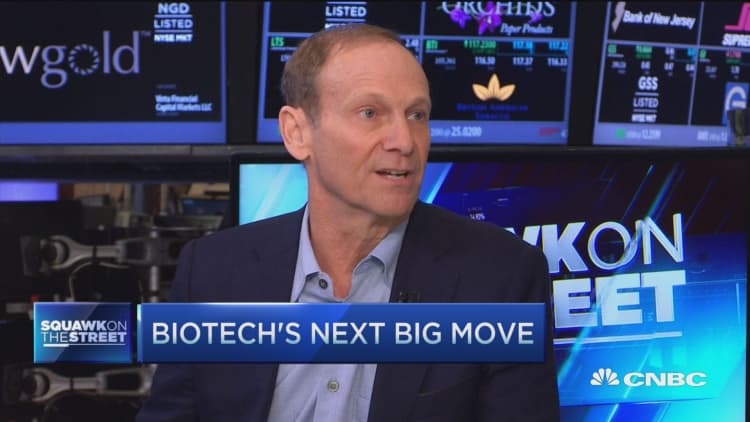

Joe Edelman, CEO of Perceptive Advisors and manager of the fund since its inception, told CNBC's "Squawk on the Street" that Hillary Clinton is incorrect on the issue.

"Well, she's wrong. I understand the idea that [with] high drug prices in general, you'd rather have them low if you could, but there's a balance," Edelman said Wednesday.

He discussed his current favorite stocks on the show and, in a CNBC Pro exclusive video with Meg Tirrell, he handicapped the prospects for one particular hot biotech looking to score a big FDA win next month.

Edelman on Clinton, stock picks:

Edelman takes issue with the spotlight on Valeant Pharmaceuticals, which has been a target of Clinton's drug-pricing reform rhetoric. He said that the problem is that Valeant is an acquisition-oriented company and doesn't invest in research and development the way that most names in biotech do.

"First of all, high drug prices are a good thing ... not because I'm an investor at all. It's basically a risk-reward question. Drugs are very risky to develop. So if you want the maximum amount of risk taken ... the greater the reward, the more people like me will invest, the more drug companies will invest," Edelman said.

"You have drugs aimed at very small patient populations where if you couldn't charge in the hundreds of thousands, those drugs wouldn't be around," he added.

Read MoreAnalyst who called Apple sell-off: Rebound ahead

Edelman is very bullish on Sarepta Therapeutics, which currently has a drug to treat Duchenne muscular dystrophy aiming for accelerated approval from the FDA.

"It's a very controversial name. I will say there's clear binary risk. The drug's either going to be approved or not approved," he said. "Most people believe it won't get approved. We believe that it will. I find it hard to believe that the FDA would turn it down."

Exclusive: Edelman on Sarepta's FDA chances

Edelman also said that Sarepta's drug for the rare disorder is much better than BioMarin Pharmaceutical's drug for the disease, which was rejected by the FDA in January.

"It was a bad drug. It was toxic. It didn't work," Edelman said. "This is a disease caused by the lack of a protein called dystrophin. So the drug, obviously to work, has to make dystrophin."

Another pick in the sector from Edelman is Amicus Therapeutics, which is currently trying to get its drug for Fabry disease approved in Europe.

"Very well-run company. We think they'll have the best-in-class drugs for that disease by the end of this year in both Europe and the United States," he said.

Disclosure: Sarepta and Amicus are among the top holdings in the Perceptive Life Sciences Fund, according to the latest quarterly filings. The manager owns a minor call option position in Valeant, according to the same filings.