Global trade flows are sluggish and should be double their present levels, according to the Organization for Economic Co-operation and Development (OECD).

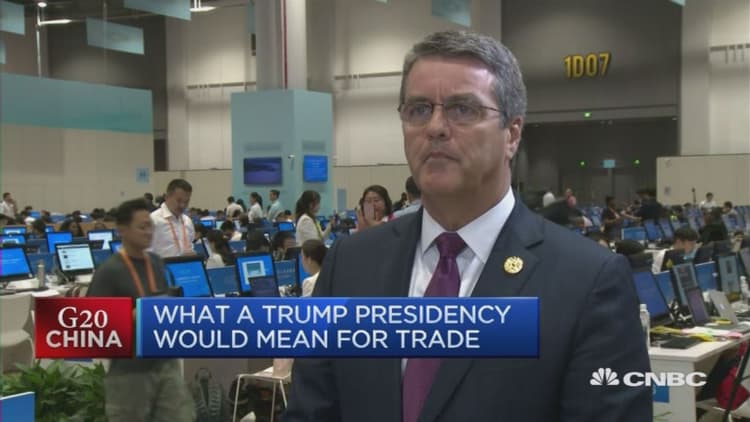

"Trade growth is below 3 percent, it should be at 6-7 percent and act as a locomotive ... We look like we're going backwards," Angel Gurria, OECD secretary-general, told CNBC over the weekend.

Stalled progress over the Transatlantic Trade and Investment Partnership (TTIP) isn't helping either, he said, speaking on the sidelines of the Group of Twenty (G-20) summit in Hangzhou.

The TTIP is set to be one of the world's largest trade pact alongside the Trans-Pacific Partnership (TPP) but a number of politicians, including French trade minister Matthias Fekl as well as U.S. presidential hopefuls Donald Trump and Hillary Clinton, have rejected the idea.

"The TTIP rules make a lot of sense. But that's why it's so difficult and so important, that's why it's going to take time. We believe it's a win-win proposition, we believe it should be pursued," stated Gurria, who's held his post at the OECD for a decade.

On taxes

As heated debate rages over Apple's tax arrangements with the Irish government, the OECD hopes its efforts to create new tax regulations will prevent another case from happening in the future.

Presently, there are 3,000 or more tax treaties that have been signed among different countries, Gurria noted.

"We're going to be modifying those into one, single multilateral agreement by all the parties involved so that everybody can move towards a transparent world, one where can avoid avoidance of tax payments," he explained.

The new framework address concerns about base erosion and profit shifting (BEPS), tax avoidance strategies that exploit gaps in rules to artificially shift profits to low or no-tax locations. Among the new measures in the OECD's plan are minimum standards to revision of existing standards and guidance on best practices.

Last week, the EC ruled that Ireland must recover up to 13 billion euros ($14.5 billion), as well as a sizable interest, in "illegal tax benefits" from Apple, whose European headquarters is in Cork.

That prompted CEO Tim Cook to lash out against the EC in a public letter, accusing the body of ignoring Ireland's current laws and upending the international tax system.

On China

Solutions to industrial overcapacity are a key issue at the on-going G-20 meeting, with China in particular focus. An inventory build-up in the country's commodities sector, especially steel, has depressed global prices and caused factories to shut down.

Gurria warned that cutting down production was the only way to fully resolve the issue of overcapacity.

So far, Beijing's solution has been debt restructuring, including debt to equity swap, but Gurria believed that may only work under certain circumstances.

"You need debt restructuring in some cases, maybe in the cases of companies that may have been overinvested and finding it hard to live with their financial obligations."