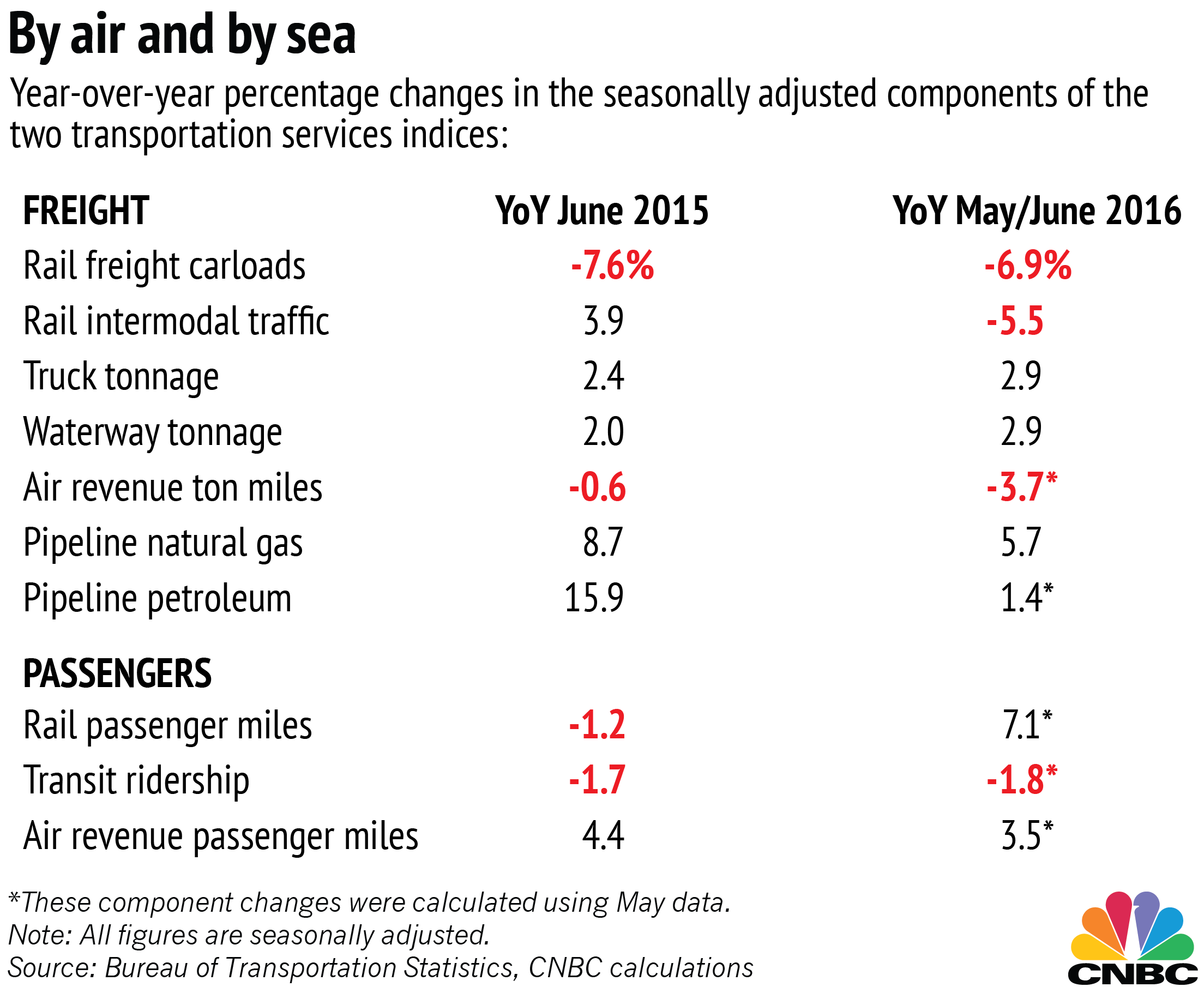

A look at the recent shift in each component suggests that intermodal rail traffic — goods that are moved by multiple modes of transportation — as well as air transportation of freight and mail, and pipeline transportation are influencing the freight index.

The BTS encourages analysts to use the TSI indexes they provide in economic models, but does not itself forecast the expected states of the economy, said Dave Smallen, a BTS spokesperson. Smallen did not comment on whether the bureau has in recent months seen the same downward pattern that CNBC's analysis reveals.

"We agree that the TSI can be useful as an economic indicator," said Smallen. "Our past research has shown that a peak in freight TSI has almost always been followed by either a recession or a growth slowdown."

In its last look at the historical data in 2014, BTS found that the passenger TSI anticipated the four most recent recessions, but that it also pointed to one more cycle that did not correspond with a recession. The freight index aligned with nearly every turning point in growth cycles since 1981, but also experienced a cycle from 2004 to 2006 that didn't line up with a downturn.

According to The Wall Street Journal's regular survey of more than 60 economists, the chance in August of a recession sometime in the next year was around 21 percent, compared with about 8 percent a year ago. Three-fourths of economists also said that the risks to their GDP growth forecasts in the next year are more to the downside than upside.

As for the stock market, airlines have been underperforming the S&P 500 so far this year by 30 percentage points. Railroad stocks have been outperforming by about 10 points. The sector overall has shown some signs of rebounding: as of Thursday morning, S&P 500 transportation stocks are up nearly 3 percent over the last month, while the S&P has been flat.