Carl Icahn, who was named a special advisor on regulation to Donald Trump, is pushing to repeal part of a rule that has a negative impact on one of his energy investments.

Former White House ethics lawyers say the billionaire's appointment to the informal role, given his stake in refiner CVR Energy, represents a conflict of interest and could put him at risk of violating conflicts laws.

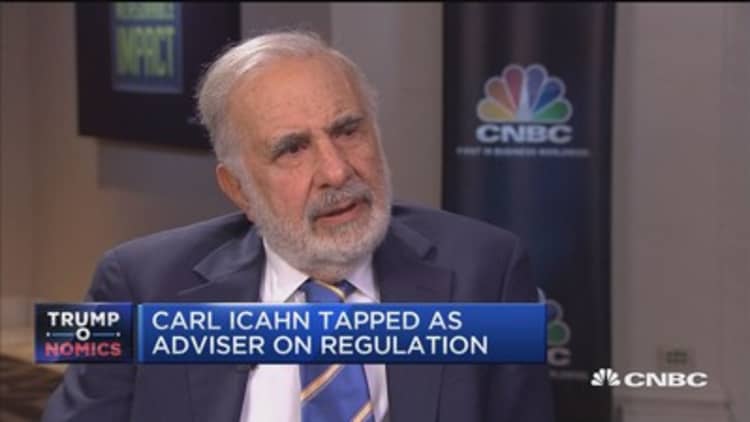

The rule in question requires refiners to blend ethanol, a renewable fuel, into gasoline. In an interview on CNBC's "Fast Money: Halftime Report," Icahn said the Environmental Protection Agency should immediately revoke part of the rule that requires refiners that cannot blend ethanol into gasoline to buy credits instead.

If Icahn's advice in his capacity as special adviser on regulation contributed to such a repeal, he would have inherently aided in removing a disadvantage for CVR Energy. Repeal of the regulation would potentially boost CVR's stock price and enrich Icahn.

Shares of CVR Energy rose 11.5 percent on Thursday after Trump named Icahn to the role. Icahn Associates holds 82 percent of CVR Energy's outstanding shares, according to FactSet data.

It appears that he may end up as a de facto special government employee. As such, he would be subject to the conflicts rules.Norman Eisenformer chief ethics lawyer to President Barack Obama

The Trump transition team did not immediately return CNBC's phone call or emails requesting comment.

Earlier, the Trump transition team said Icahn "will be advising the President in his individual capacity and will not be serving as a federal employee or a Special Government Employee and will not have any specific duties."

Still, Norman Eisen, the former chief ethics lawyer to President Barack Obama, said Icahn should beware, because the situation may pose a violation of conflict of interest and other laws, some of which could carry a criminal penalty. He said Icahn's duties may go beyond informal advising, given that he has a formal title as special advisor, sweeping responsibilities and potentially influence over personnel choices.

"It appears that he may end up as a de facto special government employee. As such, he would be subject to the conflicts rules, including under 18 USC 208," Eisen told CNBC, referring to a law that restricts people with a financial interest from advising the president.

"If so, that would make him potentially criminally liable if he worked on a repeal of the ethanol mandate that would boost CVR's stock price and enrich him. Of course, that's a lot of ifs, and we have to see what his actual conduct is," said Eisen, now a fellow at the Brookings Institution.

In a statement to CNBC, Jesse Lynn, general counsel at Icahn Enterprises, said, "Mr. Icahn is well aware of his obligations under the law generally and with respect to 18 U.S.C. 208 specifically. He will follow the law as he always has."

He reiterated the Trump Team's message that "unlike a government employee, [Icahn] will have no official role or duties." He added that Icahn will not be in a position to set policy, but will instead offer suggestions.

Eisen said the press release announcing Icahn's appointment does not provide sufficient details about what Icahn "will and will not do, and how he will avoid tripping into" the role of special government employee.

To be sure, it is not yet certain whether Icahn will actively lobby to repeal the regulation, but in Thursday's CNBC interview, he gave some indication that it's on his agenda.

Asked what specific regulations he would target, Icahn said, "If you look at the EPA, which I've talked about quite a bit, there is nothing more absurd — and I've talked about this before — than this regulation concerning the obligated party, being refineries."

He said it was "insane" to require refiners to blend ethanol into gasoline. He also said it was "insane" that the credits for those who don't blend ethanol are traded openly. Trading in the credits can drive up the price.

In an answer to a follow-up question on when he expected regulations to be rolled back, Icahn said, "I believe that in the EPA, concerning regulations relative to refineries, you really need to roll back almost yesterday."

Richard Painter, a former chief ethics lawyer to George W. Bush and longtime critic of Trump, said it would be a "huge conflict" if Icahn advised Trump on the ethanol mandate. In an email to CNBC, Painter noted that the Trump transition team says Icahn "is not a government employee (they may be wrong on this if he acts like one) so it looks like they are saying the rules won't apply to him."

"As far as I'm concerned, I don't have any specific duties," Icahn said on CNBC. "What I'm going to be doing is basically talk to Donald as I've talked before."

Icahn has long been a critic of the Renewable Fuel Standard, which requires refiners to blend ethanol and other biofuels with gasoline.

Under the standard passed under George W. Bush's adminstration, refiners are required to either blend some ethanol into gasoline or buy credits called Renewable Identification Numbers, or RINs.

Large refiners that operate gas stations have an advantage in this system because they can blend the gasoline and send it to their pumps to be sold to consumers. That means they have to buy fewer RINs.

But smaller merchant refiners like CVR Energy do not have blending operations and instead sell gasoline in bulk to traders. As a result, they have to buy RINs to comply with the ethanol mandate.

Icahn said he opposes the regulation because it stresses refiners' finances and prevents them from investing in their facilities. He has warned that the cost burdens associated with RINs could push some refiners into bankruptcy, which would lead to higher gasoline prices.

That could have ripple effects that "would absolutely wreck America's economy," he wrote in a Wall Street Journal editorial.