Since Trump was elected in early November, the S&P 500 has climbed nearly 5 percent and has hit record levels multiple times. But market observers worry that increased value from the president-elect's potential deregulation measures has already been priced in to many stocks. Further, many top economists don't foresee the booming economy Trump expects from his policies.

Some of the market optimism is thanks to Trump's promise to substantially boost infrastructure spending as a way to increase jobs. That has observers wondering about the Fed's response to fiscal stimulus. An rise in spending too could spur increased inflation: Trump has been sketchy on the details, but experts say the infrastructure spending could cost $1 trillion or more. That could push the Fed to raise rates further and faster if inflation follows.

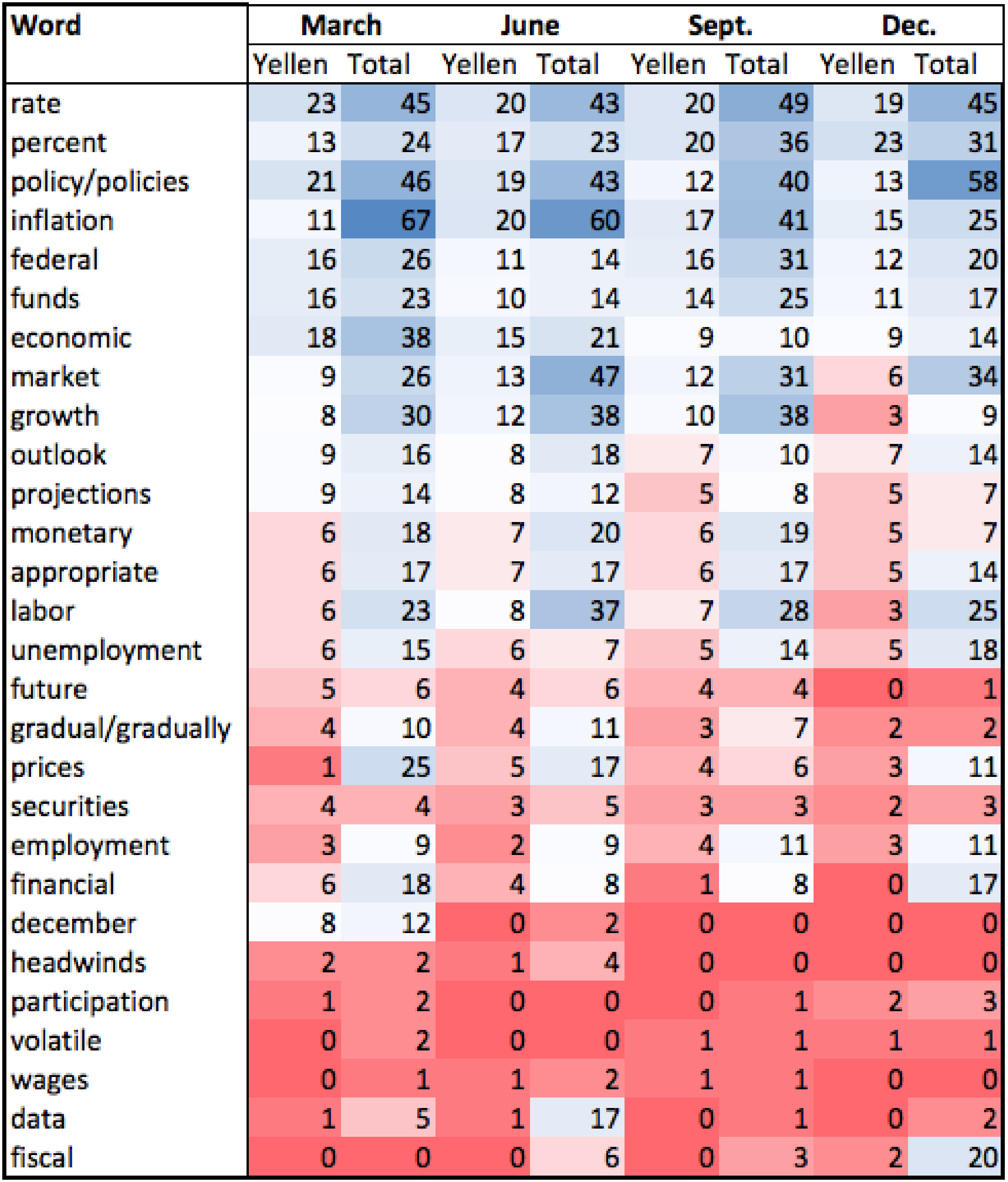

Despite that looming issue, talk of inflation at Fed meetings has gone down, especially among reporters. "Inflation" or "inflationary" was said 25 times in the December meeting, down from 67 in March and a low for the year.

Use of the word "monetary" fell in December to seven times, down from 19 in September, while "fiscal" rose overall.

Unemployment has fallen significantly in the last years of the Obama administration and hit a nine-year low of 4.6 percent in November. Use of the words "employment" and "unemployment" has remained relatively steady at Fed news conferences in 2016.