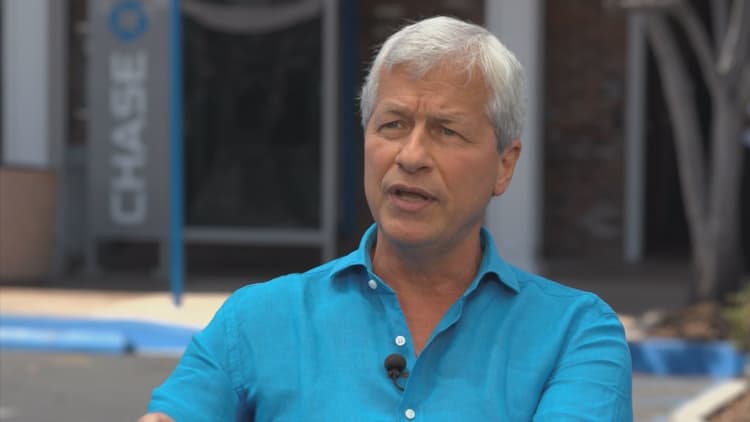

Jamie Dimon, chairman and chief executive officer of J.P. Morgan Chase, is bullish on the U.S. economy, which is in the latter stages of one of the longest expansions in history.

But when asked Monday on CNBC's "Closing Bell" what the single biggest risk to the economy is, Dimon had two answers. First, the U.S. trade dispute with China, if it escalates into a full-blown war, would erase much of the progress the Trump administration has made, he said.

And then there's the unwinding of unprecedented efforts by central banks around the world a decade after the 2008 financial crisis. Dubbed "quantitative easing," the Federal Reserve and other central banks purchased trillions of dollars of government bonds and other securities to help nurse the economy back to health. They are now starting to reverse course. Dimon told CNBC that he is concerned about what happens when that support is pulled back.

"I don't want to scare the public, but we've never had QE," Dimon said. "We've never had the reversal. Regulations are different. Monetary transmission is different. Governments have borrowed too much debt, and people can panic when things change."

Dimon, 62, has also previously warned of the possibility that the Fed will have to hike interest rates faster than expected, slamming the brakes on growth. The recurring theme: policymakers are in uncharted waters. Adding to the risk is the fact that the administration is looking at imposing another round of tariffs on $200 billion in Chinese goods. Dimon said Monday that he told the administration that he and other business leaders disagreed on the tactics, but that President Donald Trump "obviously doesn't agree with us."

Dimon is the longest tenured of CEOs leading a major U.S. bank. Once his friend, Goldman Sachs' Lloyd Blankfein, steps down in October, he will also be the only bank CEO still working to have steered his firm through the financial crisis. Given Dimon's record, investors and analysts often track his every word, from media appearances to conferences to his annual investor letter.

Dimon said Monday that he and J.P. Morgan's board believes there are several executives who could eventually succeed him as CEO in about five years.

Apart from the trade dispute and QE unwind, Dimon has been consistently optimistic about the strength of the U.S. economy and the prospects for banks. During a conference call with analysts this month after posting record second-quarter profit of $8.32 billion, he said there weren't a lot of things out there that could derail growth, which has been accelerating.

"Finally, people are going back to the workforce," Dimon said. "The consumer balance sheet is in good shape. Capital expenditures are going up. Household formation is going up. Homebuilding is in short supply. The banking system is very, very healthy compared to the past."