More than 38 million people have filed for jobless claims since the coronavirus pandemic started.

The unexpected loss in income is causing many Americans to tap their retirement savings just to make ends meet. And many people who lost a job — or have a spouse or partner whose income has declined — didn't have much money saved in the first place.

Half of Americans who were recently furloughed or let go have saved less than $500 for retirement in the past year — and 70% have saved less than $1,000, according to a report by fintech firm SimplyWise. Of those who have an individual retirement account, 401(k) plan or retirement savings account, 1 in 5 now plan to tap those funds.

"It's hard to think about the future when the present feels impossible, particularly given this unprecedented crisis," said SimplyWise CEO Sam Abbas. "It's already hard for Americans to save, let alone for their future and retirement."

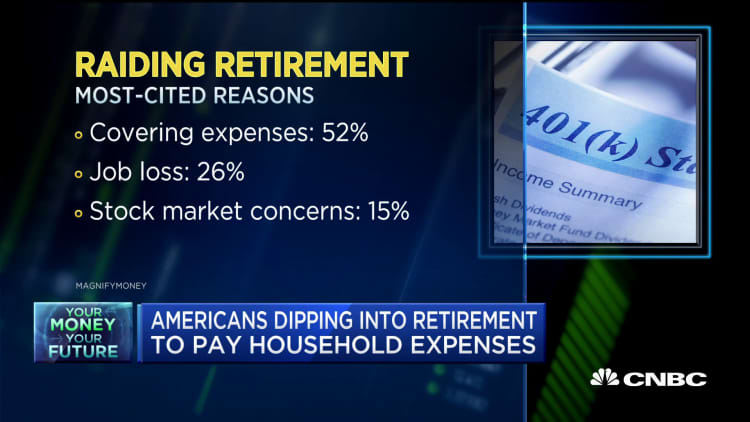

Many Americans are raiding their retirement accounts to pay for basic necessities, including groceries and household bills, according to another survey by MagnifyMoney. More than a quarter of people who've withdrawn retirement funds in the past two months said they did so after a job loss, while only 15% said they'd pulled money out of retirement accounts because they're worried about stock market losses.

More from Invest in You:

Expert tips on coping with coronavirus-related money stressors

These Gen Xers share their personal concerns about an uncertain future

Op-Ed: We're in the middle of a mental-health crisis

Nearly 1 in 4 who tapped their retirement savings said they wanted to take advantage of new legislation allowing for penalty free withdrawals. Under the $2 trillion coronavirus relief package, there is no early withdrawal penalty on coronavirus-related withdrawals of up to $100,000 from IRAs, 401(k)s and other qualified retirement accounts until the end of the year.

Over the last two months, the average withdrawal from retirement accounts was $6,757, MagnifyMoney found. However, many financial experts are concerned that the number of people and the amount of money being taken out of those accounts could significantly increase over the next few months.

Since the $100,000 withdrawal limit is for the aggregate amount of coronavirus-related distributions through Dec. 30, 2020, some retirement plan sponsors said account holders may try to imitate a "paycheck" every two to three weeks through 401(k) withdrawals, taking out a couple thousand dollars each time.

"It's helpful for participants to have access to money in a time of need, but there is concern that distributions will not be returned to accounts, which will negatively affect their ability to save for retirement." said Kevin Collins, head of retirement plan services at T. Rowe Price.

Most financial advisors say it's important to consider all other options before dipping into retirement savings. Assess your financial position today — and plan ahead.

"Everyone has to look at their own situation," said certified financial planner Lawrence Sprung, founder of Mitlin Financial in Hauppauge, New York. "If you're behind the eight ball and don't have assets in emergency funds or retirement savings, use this as an eye-opener."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: An NFL player walked away from a $925,000 salary to pursue his 'passion' - here's what he's doing now via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.