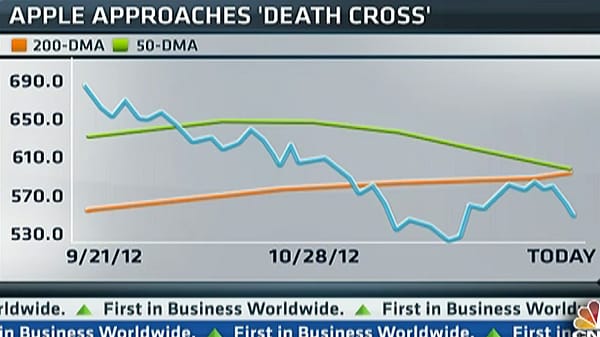

Apple stock saw biggest single-day drop, approaching the bearish "death cross," but CNBC's "Fast Money" pros diverged on whether the stock was still worth buying.

Josh Brown of RiskReversal.com discounted talk of a margin requirement change – from 30 percent to 60 percent – from COR Clearing.

"It gets important if it's bigger firms, but the chatter about the firm today, how much Apple could really be sitting there, No. 1," he said. "No. 2, I think what we're doing here is we're taking price and we're trying to retrofit it with fundamental reasons where maybe some don't exist. A lot of this is mechanical."

Brown saw it as profit-taking.

"You've got people with huge gains, why not trim?" he added. "It's had a huge snap back. I think really all that's happening, and none of that is fundamental."

Apple shares also approached the "death cross," which occurs when a stock's 50-day moving average drops below its 200-day moving average.

Stephen Weiss of Short Hills Capital brushed aside the effect of the "death cross."

"They're taking profits, pure and simple," he said. "There's no rush to buy is the bottom line."

OptionMonster's Pete Najarian urged keeping perspective on Apple.

"If you trim off one of the digits of this stock and we're looking at it and we go, 'Well, it's down 4 percent,' I don't think we'd all talk about it," he said. "It's a $23 move on a $500, $600 stock. Let's kind of keep a little perspective on Apple right now."

Enis Taner of RiskReversal.com sounded cautious – not apocalyptic – on the stock.

"The technicals don't look that good," he said. "The stock has missed earnings two straight quarters, and very few people actually talk about that. "You need to see Apple perform, I think, in the coming quarter before the stock is stabilized enough to buy it."

Taner added a notable shift in sentiment: "I think Apple's a value stock. It's no longer a growth stock."

Trader disclosure: On Dec. 5, 2012, the following stocks and commodities mentioned or intended to be mentioned on CNBC's "Fast Money" were owned by the "Fast Money" traders: Pete Najarian is long AAPL; Pete Najarian is long BAC CALLS; Pete Najarian is long JPM CALLS; Pete Najarian is long INTC CALLS; Pete Najarian is long SBUX; Pete Najarian is long FB; Pete Najarian is long FB CALLS; Pete Najarian is long MSFT; Pete Najarian is long DIS; Enis Taner is long AMZN PUTS; Enis Taner is long GS; Enis Taner is long SPY PUTS; Enis Taner is long AAPL CALL SPREAD; Enis Taner is long XLF PUTS; Enis Taner is long JCP PUT SPREAD; Enis Taner is short JCP CALL SPREAD; Stephen Weiss is long C; Stephen Weiss is long BAC; Stephen Weiss is long FCX; Stephen Weiss is short JCP; Josh Brown is long AAPL; Josh Brown is long WFC; Josh Brown is long GDX; Josh Brown is long GLD; Josh Brown is long XLU; Josh Brown is long TLT; Josh Brown is long XLF; Josh Brown is long WMT; Josh Brown is long TGT.