In other words, Cramer thinks Einhorn has gone too far.

"Einhorn can certainly question what Apple's doing with its cash, (but a lawsuit) is very wrong-headed and an unfair move," he said.

Cramer believes Apple has every right to hold that cash.

"This is a high quality problem, to say the least, a by-product of enormous success that can be solved simply by Apple raising its own dividend," said Cramer. "I have no doubt that if the company were to institute a bigger buyback and/or double its dividend shares would go higher, perhaps appreciably higher. "

However Cramer thinks the real solution is for Apple to develop new and innovative products; if the company does that – he believes everything else will fall into place.

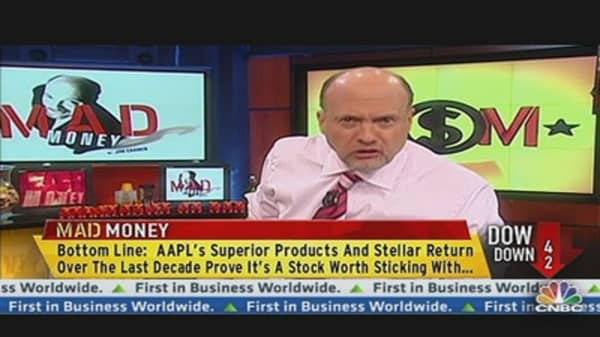

Cramer also said not to forget that although Apple's 1 year return has been lackluster – over 3 years Apple has returned 137% and over ten years Apple has returned 6000%.

"It's been able to give you that return because it's followed the dictum suggested by its late founder, Steve Jobs, that if you just produce the best products, which arguably Apple has done, everything takes care of itself."

------------------------------------------------------------------

Read More from Cramer:

Buy & Hold This One?

Cramer: Have Faith in This CEO

Don't Get Spooked by This Revenue Miss

------------------------------------------------------------------

"Oh let's not forget something else," said Cramer. "The great thing about stocks is that we are all free to sell them. If Einhorn's unhappy with the long-term record of Apple, or if he is a "what have you done for me lately" manager, he is free to sell the stock any time he wants."

In the end, Cramer thinks it will all come out in the wash. That is, the company's proper valuation will be determined by the market – no matter what it does with the cash.

"Apple's superior products and its 6000% return over the last decade speak for themselves," said Cramer. "I think they merit sticking with the company. Everything else is just artifice and a parlor game."