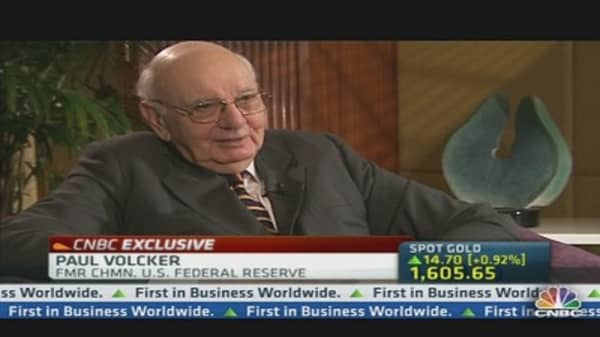

The "London Whale" risky trades involving JPMorgan is not going to spell the end of big American banks, according to Paul Volcker, former chairman of the U.S. Federal Reserve.

In an exclusive interview with CNBC in Singapore, Volcker said: "It [London Whale incident] is an embarrassment obviously to the bank and I think it's indicative of the kind of thing that we're concerned and worried about, speculative trading by banks and those activities."

The "London Whale" trading debacle was a reminder that risky trading continues even after the 2008-09 financial crisis. JPMorgan lost $6 billion from bets made by London-based trader Bruno Iksil on an index for credit default swaps. Iksil's outsized derivative positions earned him the nickname "London Whale" from traders on the other side of the bet. The incident, however, left the U.S. banking giant with a reputational black eye.

The so-called Volcker Rule passed as part of the 2010 Dodd-Frank financial overhaul bans such speculative bets by banks. Its implementation has, however, been delayed because of the complexity of the rules.

(Read more: Volcker Rule: CNBC Explains )

"Why it's taking too long? That's quite clear. We have a real problem in the U.S., too many banking agencies involved and getting them to all agree on one approach is very difficult," said Volcker.

On breaking up the U.S. banks, Volcker said that was not an easy task.

"I would rather the biggest banks be not quite so big and so complicated, but I don't know any simple road to get there," he said.

(Read more:

US Banks and Traders Way of Two-Step Stress Test

)

With regard to the U.S. Federal Reserve's role in the financial system, Volcker said: "The Fed is so focused on monetary policy that it has not been sufficiently active, in my view, on the regulatory side."