The monetary easing in the U.S. is having a limited impact on the economy, according to the President of the Philadelphia Federal Reserve, who says easing costs far outweigh the rewards.

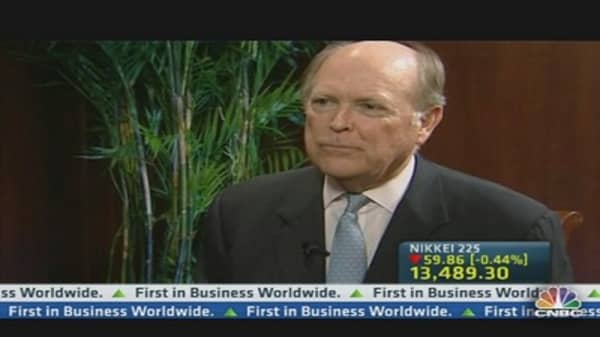

"The benefits of financial asset purchases have been very meager at best on the real economy in terms of the unemployment rate and other things," Charles Plosser, President Federal Reserve Bank of Philadelphia told CNBC on Friday. "I don't think it's having a very big impact, but it's also creating risks and challenges for us in the future."

(Read More: Some Fed Members Fear Monetary Policy Effects)

The ultra-loose monetary policy that started at the end of 2008 has had little impact on job creation with the unemployment rate at 7.6 percent, well above the Fed's target of 6.5 percent, and has resulted in the U.S. Federal Reserve's balance sheet to grow to a record of $3.21 trillion.

Plosser, a vocal critic of the U.S. stimulus measures, along with Dallas Federal Reserve President Richard Fisher, has been calling for the central bank to scale back its easing program.

(Read More: Fed Hawks Are an 'Irritant,' Ignore Them: Economist)

"I am still of the mind that the benefits don't outweigh the costs of this program," Plosser said, adding that he doesn't think there are many risks associated with dialing back the program if it was done slowly.

When asked whether it would be good for the economy at this point to scale back on easing, which would result in interest rates going up, Plosser said it really depends on what you believe is going on in the economy.

"Whether the low interest rates are merely creating financial engineering opportunities, to refund debt, to pay out, buy back stocks... and whether you really believe it's helping the man on the street and achieving our employment objectives," he added.

(Read More: I'd Be Willing to Scale Back QE, Fed's Bullard Says)

- By CNBC.com's Rajeshni Naidu-Ghelani; Follow her on Twitter @RajeshniNaidu