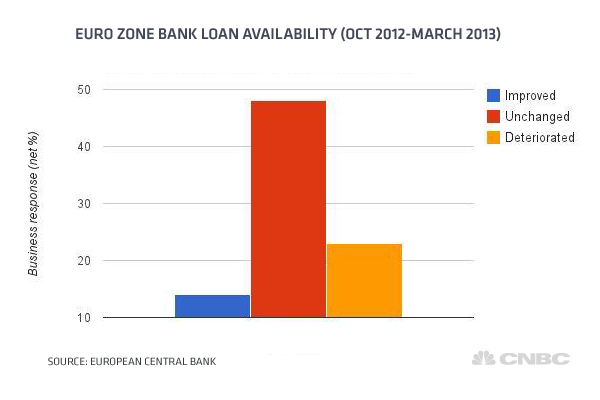

"With respect to banks' willingness to provide a loan, SMEs in all countries, with the exception of Germany (6 percent), reported, on balance, a deterioration, which was especially strong in Greece (-46 percent), Spain (-38 percent), Italy (-34 percent), Portugal (-32 percent) and the Netherlands (-30 percent)," the report found.

(Read More: ECB Rate Cut Could Bring 'Disappointment')

Spanish lenders have pulled a third of business credit, while Irish banks now lend just half what they once did, the ECB figures show.

Nicholas Spiro, head of Spiro Sovereign Strategy, said there is a disconnect between market sentiment and the real economy.

"When it comes to financial conditions, it's just the sovereign that's benefiting from the more favorable perceptions of Spain," Spiro said.

"Borrowing costs for businesses and households remain punitive and show how the transmission mechanism is still impairing the European Central Bank's monetary policy," he added.

(Read More: 'Sense of Urgency' as ECB Rate Cut Talk Rises)

Norman Villamin, European CIO at private bank Coutts said a TARP like system was needed in order to by-pass the dysfunctional banks that are still not lending.

"Non-functioning banking systems are the issue, rather than an absence of liquidity. So for ECB action to be truly effective, we think it needs to include direct lending by either the ECB itself or some supra-national agency (e.g. the European Investment Bank), bypassing the dysfunctional banks," said Villamin.

"If European Union policymakers move decisively in the direction of a TARP-like program, this would finally provide the catalyst for attractively valued European equities to rally," he said.

—By CNBC.com's Jenny Cosgrave; Follow her on Twitter @jenny_cosgrave