While some traders and investors fled the market after two big geopolitical events in the market — the downing of the Malaysian plane and the Israeli ground offensive in Gaza — I was among the risk takers who jumped in.

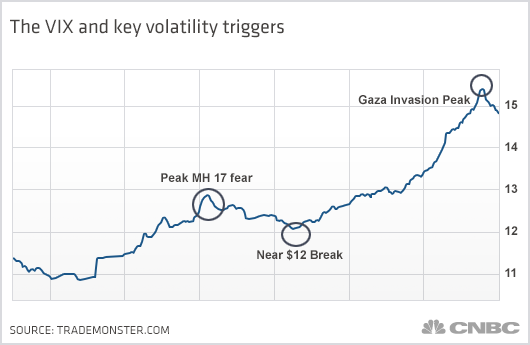

The CBOE volatility index shot above 15 on Thursday, after closing the previous session at 11. So, I sold the SPX and SPY puts as well as VIX calls into this massive pump in fear.

Read MoreWhat real traders (not the machines) are worried about: NYSE floor trader

In the final 20 minutes of trading Thursday, we noted huge blocks of VIX upside calls being sold, as traders bet the markets would stabilize at worst. They were betting that such normalization would drive volatility back down, thus allowing the sellers of those pumped-up premiums to reap modest profits.

But our markets didn't just stabilize — they rallied, massively.

Here's what the VIX looked like on Thursday:

The huge rally of 1.5 percent in the Nasdaq and near 1 percent in Dow Jones Industrial Average and S&P 500 on Friday caused the puts and VIX (derivative of S&P 500 implied volatility) to decrease in value dramatically.

How dramatically? Well, the weekly put options that expire next Friday in the SPY ($195.50 puts) closed at $1.32 Thursday night with the SPY at $195.50. Friday, as the SPY rallied $2, those $195.50 puts fell to $40, losing two-thirds of their value in less than 24 hours!

Read MoreCramer: It's a mistake to buy stocks right now

I always say that my brother Pete and I follow the smart money — typically the large players. We determine this by tracking blocks of stock, options and futures that are large enough to filter out all but the biggest players. Our algorithm known as HeatSeeker scans the markets in nanosecond time frames to see trades that might be otherwise buried under the massive quote traffic that results from up to 7 million quotes per second.

The smart money isn't always right, but especially on big moves like Thursday, it tells us if the big players have exhausted their liquidity and are sitting on the sideline — or whether they saw an opportunity they couldn't resist. Happily for our markets — and your retirement accounts — the latter played out.

Read MoreBigger worry than geopolitics? The Fed

"Fast Money" trader Jon Najarian is a professional investor, money manager, media analyst and co-founder of optionMONSTER and tradeMONSTER. He worked as a floor trader for 25 years and before that, he was a linebacker for the Chicago Bears. Follow him on Twitter @optionmonster.