Sebastianus Hendro Kistanto, an IT technician in the Indonesian city of Semarang, always drank Coca-Cola, even after he stopped working for the US soft-drinks company's operation in the country.

That was until he picked up his first bottle of Big Cola last year, attracted by the low price – just Rp3,000 (25 cents) for a 535ml serving. "Coke has the best taste but Big Cola costs much less," he says, adding that he drinks about four bottles a week.

Like many of the growing number of Big Cola drinkers in Asia, Mr Kistanto wrongly believed it came from the UK, an easy mistake as the logo of the English Football Association looms larger on the bottle than the brand name. In fact, Big Cola is from Peru, and the FA logo is there as part of an ambitious marketing push.

More from The Financial Times:

China detains five in meat probe

Premier Foods focuses on a second-half turnround

Tesco turns to man behind Dove's 'love your body' campaign

The company that owns Big Cola, family-owned AJE Group, is one of the Andean nation's biggest international corporate success stories.

A combination of a low-cost strategy, clever marketing and relentless focus on emerging markets has helped this little-known company take on Coke and Pepsi, the global soft drink giants, in Latin America and Asia. In the process it is showing how a nimble developing-world rival can use its home market experience to tap into demand from hundreds of millions of new consumers in emerging markets.

Read MorePepsiCo quarterly profit falls 2 percent

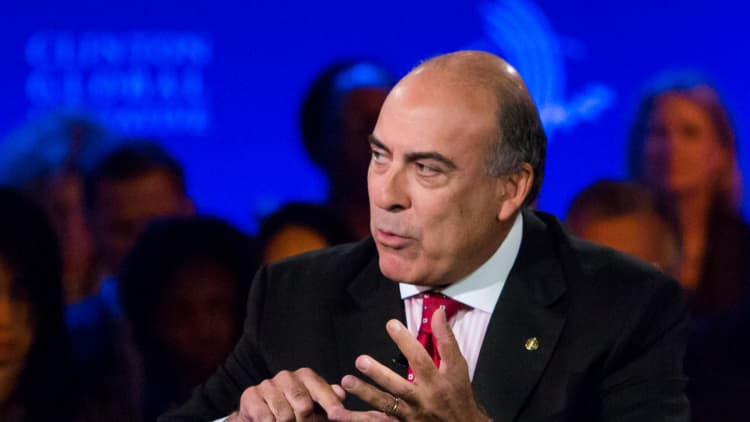

"This is one of the most competitive categories in the world," says Antonio Soto, smooth-talking Spanish head of AJE's Asian business and a former president of PepsiCo in Spain. "If you had asked me five years ago, when I was running PepsiCo in Spain, if what these guys have done is possible, I would have said no."

Ironically, this capitalist triumph owes its origins to the Shining Path Maoist rebellion of the 1980s, when tens of thousands were killed. AJE was started by five siblings in the Añaños family in 1988 after waves of violence sweeping the countryside forced them to flee their farm for the small city of Ayacucho. As Ángel Añaños, AJE's president and one of the founders, once put it: "Thanks to terrorism, we were able to change sectors and start in this industry."

With access to many products including Coke cut off, they made their own cola – called Kola Real in Peru – in their back yard and sold it in empty beer bottles. "It was quite a difficult time, [but] when many people saw problems and risks, the Añaños siblings found an opportunity and took advantage," says Gonzalo Begazo, the Lima-based executive financial vice-president for AJE.

Read More

The four brothers and one sister, who own 100 per cent of the company, expanded into other Latin American countries before making the leap into Asia in 2006, starting in Thailand.

The fifth-biggest soft drinks company in Latin America, AJE last year ranked 21 of all soft drinks makers globally, according to market researcher Euromonitor, with sales of about $2bn. AJE's global sales grew at an average of 22 per cent a year from 2000 to 2013, but its share of the global market was 0.4 per cent, compared to Coke's 25 per cent and 10.7 per cent for Pepsi.

Based in Madrid so he can bridge the times zones between Latin America and Asia, Mr Soto is in southeast Asia 15 days a month. He says the family entered Asia because they felt instinctively that they could win over "bottom of the pyramid" consumers rather than because they had undertaken detailed market studies.

That epitomises a corporate culture focused on risk-taking and moving fast – in stark contrast to Mr Soto's former employer, he says, on a tour of AJE's newest, state of the art bottling plant on the outskirts of Jakarta, its third factory in Indonesia. "At AJE, you have access directly to the board and decisions are made like this," he says, clicking his fingers.

Whatever the corporate structure, consumer goods companies need an extensive distribution network if they are to conquer Indonesia, the world's biggest archipelago nation. While Coke relies on a global network of local bottling companies, AJE does all the manufacturing and then works with local distributors.

From its headquarters in the Cikarang industrial estate outside Jakarta to the roadside shacks from Java to Sulawesi where its products are often sold, AJE's aim is to keep costs, and therefore prices, low. "The consumption of soft drinks in emerging markets is a question of affordability, as well as availability," Mr Soto says.

It is also a question of tapping demand among those less attuned to the health risks of sugary drinks.

Catherine Eddy, managing director of the Indonesian office of Nielsen, the researcher, says that as wealthier consumers become more health conscious, companies selling sugary soft drinks will focus more on lower income consumers in countries such as Indonesia. "Big Cola has a very low price point and the low-end consumers are not worried about health," she says. "They want products that are fun and affordable."

Read MorePeltz: There 'could be' a proxy contest with Pepsi

The company's strategy is to sell products that are similar to its rivals' but at a price 25 per cent lower.

Although AJE had no previous experience of southeast Asia and its diverse cultures, religions and tastes, it does understand poor consumers' concept of value.

For UK shoppers at a Tesco supermarket in Surrey, value is about how many items they can fit in their trolley each week for the same amount of money, Mr Soto says. For people living on the crowded outskirts of booming Asian or Latin American cities, earning a few dollars a day, value is all about the money in their pocket. If Big Cola consumers only have Rp3,000 they can buy Big Cola but they cannot afford to buy the more expensive rival products, he says.

When costs rise and spending power is squeezed, as has happened in Indonesia because of a rise in fuel prices and a weakening currency, companies serving lower-income consumers cannot risk raising their prices. Instead they shrink the unit size, as AJE did by launching a 300ml Big Cola bottle selling for Rp2,000. Coke and Pepsi have responded with advertising, discounts and smaller bottles.

But Mr Soto claims that after just four years in Indonesia, AJE has secured about 40 per cent of the Indonesian market for carbonated soft drinks, which reached about 1bn litres last year, and is worth about $1bn according to Euromonitor. The aim is to grow by double digits in Indonesia, faster than the market, which is predicted by Euromonitor to expand by an average 5.6 per cent annually during the next four years.

Read MorePOM notches legal win in Coke's fruit juice battle

As southeast Asia's biggest economy and Big Cola's biggest market in Asia, Indonesia must take the lead for AJE if its Asian sales are to rise from 30 per cent to its target of 50 per cent of total revenue.

The company is also moving into non-carbonated drinks, a much bigger sector in Indonesia, with juices and energy drinks. Most of the products will be the same as sold in Latin America, but AJE makes some adjustments for local tastes, for example removing caffeine from Big Cola in Asia.

As its international business grows, AJE recognises it must increase its investment and build a bigger corporate structure, a move previously avoided by the family.

Does AJE risk losing the pioneer spirit that drove its initial growth? Mr Soto admits it is still "taking baby steps" towards becoming a leading multinational but says AJE can find the right balance.

"What brought us here in the last 25 years is probably not what will take us to where we want to be," he says.

—By Ben Bland and Andres Schipani, The Financial Times. Additional reporting by Irene Astuti.