You know the old saying: War is good for the economy. Is the Israeli stock market an example that this saying is in fact more maxim than enduring myth?

There's always been an investor line of reasoning that the right move is to reduce holdings where there's a conflict—no one likes the uncertainty that comes with escalating violence. But Israel may be an exception to the idea that conflict sends stock investors on a flight to safer markets.

The fighting in Gaza has not deterred investors from buying into Israel's market. In fact, since July 8, the day after Israel's air strikes began, the Tel Aviv 100 (TA-100), an index of the 100 largest-cap companies in the country, has climbed by 2.3 percent. It's also up nearly 13 percent over the last 12 months. The Israeli stock market hasn't touched negative territory since February, well before the current conflict began.

The Israeli stock market's resiliency may come as a surprise, but to John Krey, an international investment analyst with S&P Capital IQ, the situation in Gaza is not as turbulent as investors may think.

"People are more confident that Israel can protect its sovereignty against these attacks," Krey said. "They've taken great pains to make sure that their industries and their people are not harmed in any material way."

Confidence isn't best reflected in equities, but in the Israeli fixed-income market. Between June 30 and July 8, 10-year Israel government bond yields rose 12 basis points, but then declined 17 basis points from July 8 to July 24, suggesting increased comfort among investors.

"That's really impressive," Krey said. "There's a remarkable change of attitude taking place here."

Read MoreIsrael's economy is soaring—Where's the peace?

Seeing the Israeli markets rise during a conflict is nothing new. Between November 14 and 21, the last time fighting broke out in the region, the Tel Aviv 100 rose by about 1 percent.

During the Gaza War, which took place between December 27, 2008, and January 18, 2009—notably during the global recession—the market climbed 7.9 percent.

The TA-25, a more concentrated bet on the largest Tel Aviv-listed stocks, and the broader Israeli stock market flirted with then-record levels in 2006, the same year as the war in Lebanon.

Getting used to conflict ... resolution

Part of the reason why the market doesn't collapse during times of conflict is that people are used to it and investors assume the flare-up will eventually end, said William Scholes, a portfolio manager with Aberdeen Asset Management's closed-end Aberdeen Israel Fund.

"People in the country are relatively well informed and have seen recoveries pan out in past conflicts," Scholes said. "So investors are more sanguine than you might think."

It also helps that a number of Israeli-based companies are globally focused and generate large sums of money from outside of the country, said Christine Tan, a portfolio manager with Toronto-based Excel Funds Management.

The market's largest company, generic drug giant Teva Pharmaceutical Industries, brings in 95 percent of its revenue from outside of Israel. When fighting does arise, worldwide operations are less affected than companies that generate most of their earnings from domestic consumption, Tan said.

- Teva Pharmaceutical Industries—market cap $52 billion (NYSE)

- Check Point Software—$12.9 billion (NASDAQ)

- Israel Chemicals—$10.6 billion (Tel Aviv Stock Exchange)

- Bank Hapoalim—$7.8 billion (Tel Aviv Stock Exchange)

- Taro Pharmaceutical Industries—$6.2 billion (NYSE)

Israel's market is also filled with leading technology and health-care companies. Depending on what index one looks at, the tech sector makes up between 2.5 percent and 10 percent of the Israeli stock market, while health care accounts for around 50 percent.

Read MoreSeeds of change in Ukraine threaten next corn belt

Israel's technology sector looks a lot like the tech sector in the U.S., said Bruce Schoenfeld, director of research at BlueStar Global Investors, a company that develops strategies for investing in the Israeli market. It's fairly diverse nand includes Internet companies, software operations, security firms and more. The Market Vectors ETF family offers an ETF based on the BlueStar Israel Global Index, Market Vectors Israel ETF—it captures stocks listed in Israel but also Israeli companies listed overseas. (BlackRock's iShares also offers the MSCI Israel Capped ETF.)

Tower Semiconductor, a high-growth circuit maker, is just one of the 58 listed tech companies to consider, Schoenfeld said.

"They are world-class technology companies that are based in Israel," he said.

There's still room for [stock] multiple expansion. That might not be immediately attainable, but once the hostility dies down, a truce is in place and Israeli troops have been removed, we could see the market rise further.John Kreyinternational investment analyst with S&P Capital IQ

Could now be a good time to buy into the Israeli stock market? The TA Blue Tech Index, an index that tracks Israeli-listed tech and biotech companies, has fallen 8 percent this year, though it is up 1.3 percent since the conflict began.

One reason for the decline is that 30 percent of the index is concentrated in three stocks, so there's bound to be volatility, said Gadi Beer, vice president of operations at AMIDEX Mutual Fund, a company that sells Israel-focused mutual funds. But Beer is still bullish.

"Israel's 'bread and butter' is technology, and it is not a resource that will soon be depleted," he said. "Many new ideas and products are coming out of the pipeline."

Israel's equities market looks fairly attractive, based on historical trading valuations, at 11.3 times one-year forward earnings, significantly below its all-time high of 31.8 times, as well as its historical average of 17.2 times, according to S&P Capital IQ.

Top 5 sectors in Israel equities market

- Health care—28.8 percent

- Financials—24.7 percent

- Information technology—12.8 percent

- Energy—10.8 percent

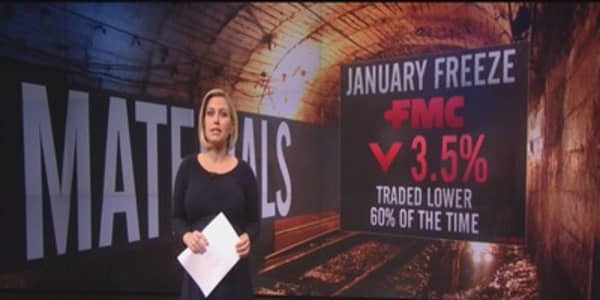

- Materials—8.8 percent

(Source: S&P Capital IQ, for 511 companies headquartered in Israel and part of Tel Aviv Stock Exchange)

Israel has an attractive long-term domestic story, too, Scholes said. Its economy is expected to grow between 3 percent and 4 percent this year: The IMF said in February that Israel's GDP would grow by 3.4 percent, ahead of most developed nations. It has a young population—the median age is 30—and its middle class is expanding.

That "emerging markets-like" demographic story and its technology and health-care sector concentration make it more of a growth play than other developed countries, Krey said, adding that the overall growth could slow during the next quarter due to the violence. Krey thinks the country could see a slight decline in GDP attributable to the conflict—the IMF has estimated a cost from the conflict to the Israeli economy of 0.2 percent GDP so far—and that could hurt stock returns.

Read MoreWhy Buffett is betting on energy stocks again

"The airline (ban) will sting—July and August are core times for tourism," Scholes said.

If the conflict drags on for an extended period of time—bucking the investor bet that a history of short, repeated conflicts will repeat itself again in this instance—or if other countries get pulled into the conflict, investors could see stock sentiment turn negative and returns suffer, Scholes said.

Krey said the Israeli market—the Tel Aviv Stock Exchange had a market cap of more than $200 billion at the beginning of the year—may not climb much higher while the fighting goes on, though there isn't a strong reason to believe it will reverse, either.

"There's still room for [stock] multiple expansion," Krey said. "That might not be immediately attainable, but once the hostility dies down, a truce is in place and Israeli troops have been removed, we could see the market rise further."

If it's easy to become convinced there's no way out of internecine Middle East conflict, stocks still find a way up, and it's not just in Israel: the Palestine Stock Exchange Index is up 0.76% since July 8, according to Bloomberg.

A brief history of war and peace—and Israel's stock market

- Operation Rainbow, May 18 to May 24, 2004: 3.1 percent*

- Operation Days of Penitence, Sept. 30 to Oct. 15, 2004: –1.85 percent

- Operation Summer Rains and Operation Autumn Clouds, June 28 to Nov. 26, 2006: 15.9 percent

- Operation Hot Winter, Feb. 28 to March 3, 2008: –2.98 percent

- Gaza War, Dec. 27, 2008, to Jan. 18, 2009: 7.9 percent

- Operation Returning Echo, March 9 to March 14, 2012: 3.3 percent

- Operation Pillar of Defense, Nov. 14 to Nov. 21, 2012: 1 percent

- Operation Protective Edge, July 8, 2014, to present: 2.24 percent

(*Returns are for the Tel Aviv 100 Index, representing the 100 largest market-cap companies listed on the Tel Aviv Stock Exchange.)

—By Bryan Borzykowksi, special to CNBC.com