U.S. stocks ended little moved on Wednesday as Wall Street caught its breath, with the S&P 500 closing at a record just above 2,000 for a second consecutive session.

"These record highs you're seeing are backed by good earnings, and not from companies cutting costs, but true earnings from sales and operations. A lot of companies have healthy balance sheets and are looking to expand, so this (bull market) is not a flash in the pan, we think we'll see 10 to 11 percent overall S&P growth this year," said Frank Fantozzi, president and CEO of Planned Financial Services in Cleveland, Ohio.

"Overall, people should enjoy what is happening," Fantozzi added.

Tiffany gained after the luxury-goods seller hiked its 2014 outlook. Smith & Wesson declined after the gun manufacturer trimmed its full-year profit forecast. Apple gained after Bloomberg News cited people familiar with the matter in reporting the company's suppliers readying to make its biggest-yet iPad.

Read MoreMidday movers: Best Buy, Smith & Wesson & more

"We had a big move yesterday; these big, round numbers have a psychological impact on investors, who are taking a pause as opposed to going significantly one way or the other," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

"We're flirting with the milestone 2,000 on the S&P 500, and there is a lack of any catalyst to jar prices above that level," Luschini added.

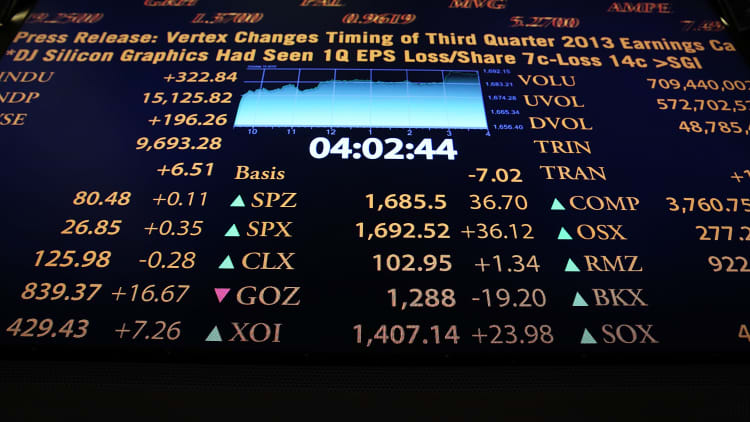

Major U.S. Indexes

After a session of fluctuating between modest gains and declines, the Dow Jones Industrial Average rose 15.31 points, or less than 0.1 percent, at 17,122.01.

Finishing at a record just above the 2,000 milestone for a second day, the added a fraction to 2,000.12, with utilities the best performing of its 10 major sectors.

The Nasdaq declined 1.02 point to 4,569.62.

Traders tracked events in Ukraine, with the U.S. State Department saying Russia had sent additional tanks and armored vehicles into Ukraine in what the Obama administration believes is a new military counteroffensive.

The CBOE Volatility Index, a measure of investor uncertainty, gained 1.3 percent at 11.78.

Advancers were a few steps ahead of decliners on the New York Stock Exchange, where an anemic 497 million shares traded. Composite volume cleared 2.3 billion.

The yield on the 10-year Treasury note fell 4 basis points to 2.36 percent, and the dollar held steady against the currencies of major U.S. trading partners.

Crude-oil futures rose 2 cents to $93.88 a barrel, and gold futures lost $1.80, or 0.1 percent, to $1,283.40 an ounce.

On Tuesday, stocks gained, lifting the Dow to an all-time high and the S&P 500 to its first finish above 2,000, after better-than-expected reports -- including a jump in orders for durable goods -- cast favorable light on the U.S. economy.

Read MoreStocks rise; S&P 500 scores first finish above 2,000

—By CNBC's Kate Gibson

Coming Up This Week:

Thursday

Earnings: Dollar General, Splunk, Abercrombie and Fitch, Toronto Dominion, Pall Corp, Signet, Canadian Imperial Bank

8:30 a.m.: Initial claims

8:30 a.m.: Q2 GDP (second reading)

10:00 a.m.: Pending home sales

11:00 a.m.: Kansas City Fed survey

1:00 p.m.: $29 7-year note auction

Friday

8:30 a.m.: Personal income/spending

9:45 a.m.: Chicago PMI

9:55 a.m.: Consumer sentiment

More From CNBC.com: