Investors are eagerly awaiting Friday's employment report, as they look to learn how many jobs were created in August. Economists polled by Reuters are looking for nonfarm payrolls to increase by 210,000.

But while the market will likely cheer news of further employment gains, some experts warn that a too-hot report could take the wind of the market's sails—as "good news is bad news" proves to be the market meme that just won't die.

"I don't think we are" out of the good-news-is-bad-news cycle, said Michael Block, chief strategist at Rhino Trading Partners. "Because every time we get a little bit of good news, there's still this very hawkish crowd that talks about how imminent a rate hike is."

Read MoreFor bonds, it's not about the Fed anymore

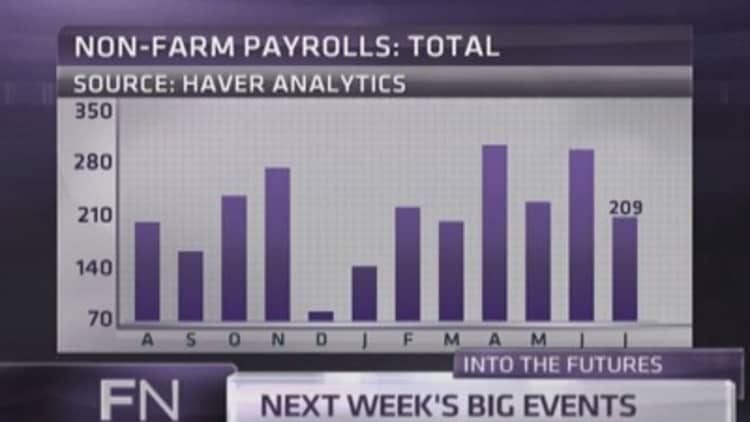

Generally, economists expect the trend of solid job growth to continue. A consensus number on Friday would mark the seventh straight month of plus-200,000 nonfarm payrolls growth. And while economists as a whole are expecting to see a near repeat of July's 209,000 jobs, some present a solid case that the number could come in a bit higher than that.

"There are no real reasons to believe that the 209,000 increase in payrolls in July, which was the smallest rise in four months, is the start of a sustained slowdown in job growth," wrote Paul Dales of Capital Economics, who expects to learn that 225,000 jobs were created. "Since the payrolls data tend to be volatile from one month to the next, we would place more weight on the six-month trend, which rose to an eight-year high in July."

Block says in order for the Federal Reserve to truly speed up its schedule for raising its fed funds rate target, "we'd have to have a number that would get to a much higher level—a 3-handle or a 4-handle—and that would have to be sustained."

Still, while it might not affect the central bank's calculus, a number even slightly above trend could worry investors.

"It not clear to me whether bad news is still good news," said Mark Dow, who writes at the Behavioral Macro Blog. "We've had different types of news, and the market seems to shrug it off. But what is clear is that people are still nervous about a correction, and they're still afraid of the Fed."

Read More The poor get poorer: Low-wage jobs still dominate

Dow, who relies on behavioral psychology to help him trade macro trends, still senses a great deal of fear in the market. He notes that either good news or bad news could ramp up some investors' correction fears (which, of course, have so far proven unfounded).

For traders like Anthony Grisanti of GRZ Energy, capitalizing on market movement is still the way to go—regardless of whether "good news is bad news," "good news is good news," or any other such permutation.

"This market has proven that it can take any hit as far as geopolitical-wise, as far as economic-wise, and keep trudging higher," he said. "So I'm willing to buy any dip in this market."

—By CNBC's Alex Rosenberg

Watch "Futures Now" Tuesdays and Thursdays at 1 p.m. ET exclusively on FuturesNow.CNBC.com!