European shares closed lower on Tuesday with investors looking ahead to a key Federal Reserve policy meeting this week as well as a referendum on Scottish independence.

Fed watched

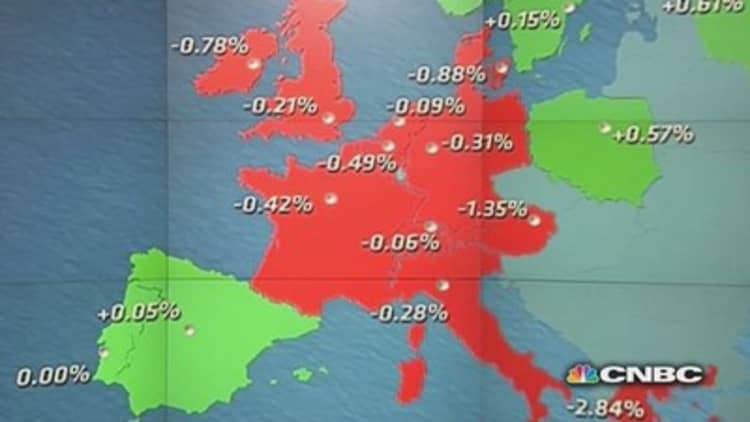

The pan-European Euro Stoxx 600 Index was provisionally down 0.35 percent lower with all sectors showing declines led by technology and financial services stocks. The U.S. Federal Reserve is expected to give more clues on the future path of U.S. monetary policy this week, with yields on benchmark Treasurys easing slightly on Tuesday morning after pushing higher in the last few trading sessions. The Fed's statement is due on Wednesday with a press conference with Chair Janet Yellen shortly afterwards.

Read MoreFed and Alibaba Effect to hang over stocks

"Traders are treading lightly ahead of the Fed meeting on Wednesday. QE (quantitative easing) is no longer of interest as many will be looking for signs to when rates will rise," David Madden, a market strategist at brokerage IG Markets said in a research note.

Walls Street was trading cautiously in the morning with the Dow Jones Industrial Average up 0,2 percent and the broader S&P 500 up about 0.34 percent.

Read More

European markets

Scotland vote nears

In Scotland, concerns regarding the upcoming vote are likely to curb risk sentiment in the near term. Polls currently show that the referendum is too close to call with both sides continuing to campaign hard. The upcoming vote - which is held on Thursday with the result expected Friday morning - has led investors to sell shares of Scottish companies, place bearish bets on the British pound and worry about the widespread implications of the potential split-off.

Hedgefunds short $-£ ahead of Scots vote

Back in Europe, U.K. August inflation dropped slightly in line with expectations, driven by a fall in the price of motor fuels and non-alcoholic drinks, official data showed.

Consumer prices rose 1.5 percent year-on-year in August, down from the 1.6 percent increase in July, the Office for National Statistics (ONS) said on Tuesday. The figure was still below the Bank of England's 2 percent inflation target.

Read MoreUK inflation slips, house price growth at 7-year high

Asos shares down

In stocks news, U.K. online retailer Asos reported fourth-quarter sales that saw a rise of 15 percent but the company highlighted that profits next year would be limited due to an uptick in investment; shares opened the session 14 percent lower and closed provisionally down 8.8 percent.

Shares of Thomas Cook slipped to end the day provisionally down 6.1 percent after the travel agent said that high levels of market capacity had led to some price softness in the sector.

Meanwhile, Air France-KLM saw its shares fall 3.3 percent with pilots staging a week-long strike in a dispute over cost cuts.

Also in France, Publicis shares rose 0.4 percent after it announced that it was parting company with COO Jean-Yves Naouri and confirmed its growth targets for 2018.

Read MorePublicis shakes up management post-Omnicom deal fail

Follow us on Twitter: @CNBCWorld