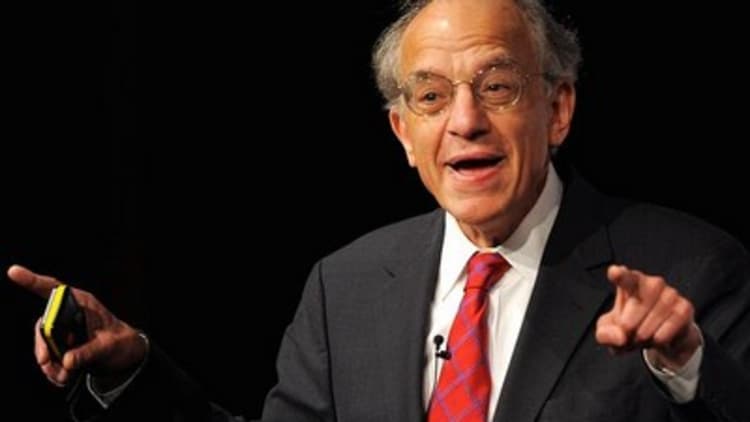

Stocks could be in for a rough ride in the next week or so as investors come to realize that the market is a "little behind the curve" on interest rates, longtime stock market bull Jeremy Siegel said Tuesday as the Federal Reserve began its two-day policy meeting.

But in the long-run, stocks should continue their march higher, the Wharton School professor added in an interview on CNBC's "Squawk Box."

"If you look at the Fed Funds futures market, they are below the rates the FOMC [Federal Open Market Committee] members believe are going to prevail at the end of the 2015 and 2016," Siegel said. "We usually think the Fed is behind the curve."

He's among the market watchers who believe the Fed will drop the phrase "considerable time" in its policy statement Wednesday when referring to how long the central bank will keep interest rates low.

Read MoreMarket reaction to Fed hinges on 2 words

"There is some room for some volatility in the market over the next week when they realize that this period of zero rates is going to end," he said. "But if you take a look at the big picture, rates are still so extraordinarily low that money will continue to flow into equities."

Standing by his prediction of 18,000 on the Dow Jones Industrial Average by year end, Siegel again made his case for why the bull market still has legs. He sees second half economic growth of 3 to 4 percent, earnings near $120, and the start of Fed rate hikes in the spring or summer of 2015.

Read MoreWall Street sees Fed hike sooner: CNBC survey

The Dow closed Monday at 17,031. So a move to 18,000 would be a 5.6 percent increase from current levels and an 8.6 percent return for the year. The Dow finished 2013 at 16,576 after soaring 26.5 percent.

It was not evident in the Dow or the S&P close Monday, but it was a rough day for investors in high-flying stocks, which dragged the Nasdaq Composite down more than 1 percent.

Market watchers say portfolio managers sold momentum stocks to make room in their funds for Alibaba, which is expected to begin trading on Friday. Late Monday, the Chinese e-commerce giant increased the price range of its IPO to $66 to $68 per share, valuing the offering at as much as $21.8 billion.

"People are pruning their portfolio ahead of Alibaba to get rid of over weights in competitors to raise money for Alibaba," said Art Cashin, director of floor operations at UBS. "The usual cat and mouse game is bigger than normal."

—By CNBC's Matthew J. Belvedere