After a busy week involving the Federal Reserve, Scotland's independence vote and the largest initial public offering in U.S. history, traders in Asia will have little on their plate over the next few days.

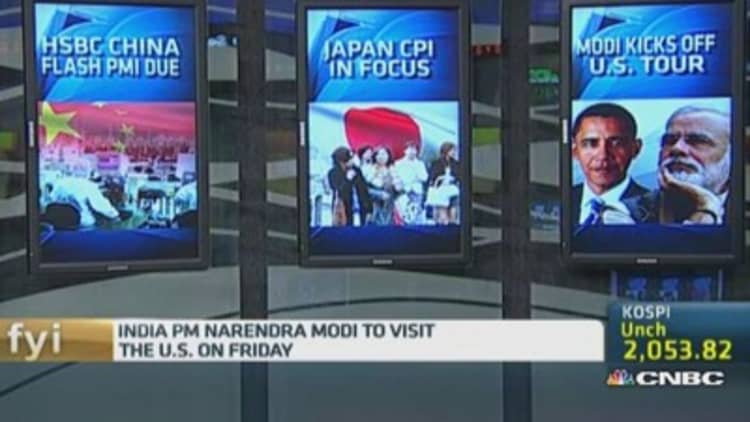

HSBC's gauge of Chinese factory activity for September is due on Tuesday. After the bank's final August reading fell to a three-month low of 50.2, investors will watch to see if the index slips below the 50 level that demarcates expansion from contraction.

The report comes amid rising fears about a correction in China's real-estate market and heightened calls for Beijing to take more action to boost economic activity. Last week, the People's Bank of China (PBoC) addressed those calls by cutting the 14-day repo rate by 20 basis points to ease short-term borrowing costs for banks as well as pumping $81 billion into the country's five largest banks.

Read MorePBOC sends 'strong signal' of rate cut

"We expect growth to be weaker in the second half of the year, as policymakers focus on structural reforms. Although Beijing appears more tolerant towards slower growth, we think decisive actions will be taken to defend the official growth bottom-line. On the heels of liquidity injections, fiscal action is a distinct possibility," said analysts at AXA Investment Managers in a note.

On Friday, traders will focus on Japan's August consumer price inflation (CPI) report.

The nationwide core consumer price index rose an annual 3.3 percent in July and analysts polled by Reuters expect inflation to continue hovering around those levels.

Moody's Analytics agrees, predicting another 3.3 percent annual rise. "Little is expected to change in the near term. Consumer demand remains weak, but firms are unlikely to cut prices. Nominal wages are not rising fast enough to keep pace with inflation," the firm said in a report.

Read MoreWeak yen fuels rush into Japanese stocks

Elsewhere, Thailand, Southeast Asia's second-biggest economy, is expected to release August trade data on Thursday. The trade balance returned to a deficit in July with exports falling 0.5 percent on year as the country's new military government continues to face challenges in reviving the economy.