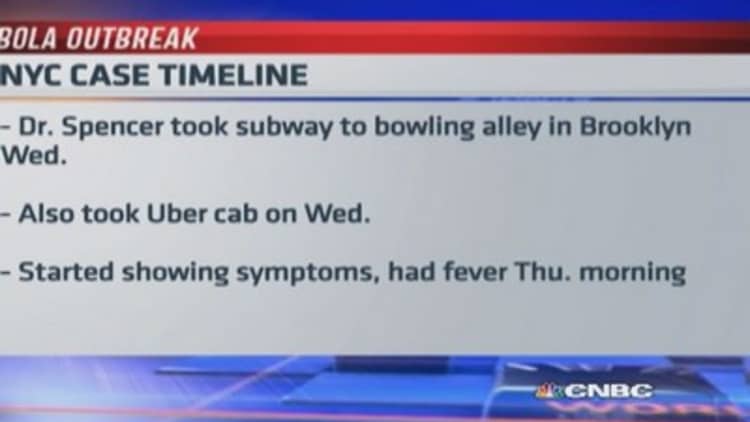

A New York doctor has tested positive for the Ebola virus after returning from treating patients in West Africa, it was announced late Thursday. News of the case has pushed shares in Asia and Europe lower and now all eyes on the U.S.

As U.S. futures broadly point to a lower open, CNBC asked a group of global equity strategists to pick out the U.S. sectors and stocks that could be affected during Friday's trading session.

Airlines

Evan Lucas, market strategist at IG, told CNBC that airline stocks and travel companies could bear the brunt of the latest Ebola case.

"The airlines particularly, they have seen solid selling over the past six weeks every time Ebola hits the headlines. [It's been the same] with travel companies," he said.

Michael Hewson, chief market analyst at CMC Markets said the "usual suspects" of airline stocks and possible other leisure stocks, such as restaurants. He named Delta and Southwest Airlines as stocks to watch today.

Leisure

McDonald's and Ruby Tuesday could be affected, Hewson told CNBC, on the risk that New Yorkers fear going out so much. "After all, if people are worried about Ebola in a big city they tend not to travel or go out as much," Hewson said.

Pharma

IG's Evan Lucas named Pfizer as one possible U.S. stock in line for a possible increase on Friday while Edmund Shing, global equity portfolio manager at BCS Asset Management, agreed that companies working on an Ebola vaccine would be ones to watch today, citing British pharmaceutical firm GlaxoSmithKline and biopharmaceutical firm Amgen -- which said last week that it would work with the Gates Foundation to ramp up production of the experimental Ebola drug ZMapp -- as ones to watch.

Johnson and Johnson is one U.S. pharma giant that has said it will start testing its Ebola vaccine in January. It said earlier this week that it aims to produce at least 1 million doses of its two-step vaccine next year. Clinical trials are already under way on vaccines created by GlaxoSmithKline and NewLink Genetics, another company whose stock price could move Friday.

Protective Equipment

Global equity portfolio manager Edmund Shing added that companies manufacturing protective equipment and clothing, such as "hazmat" suits, "actually makes more investing sense" – as "they clearly will now get a boost to sales in New York and possibly wider in the U.S." He said "Lakeland Industries is possibly the most obvious stock here."

Other companies that have seen the demand for the protective clothing they produce are DuPont and Kimberly-Clark.

- By CNBC's Holly Ellyatt. Follow her on Twitter @HollyEllyatt.