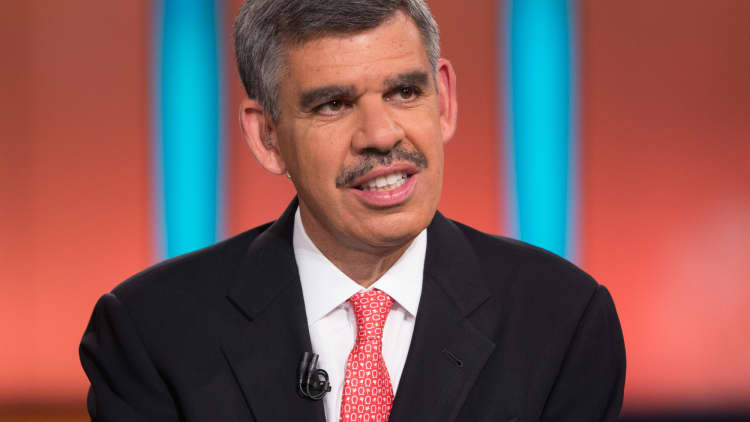

While the Federal Reserve officially halted its asset-purchasing program known as quantitative easing, the QE trade isn't quite over, Allianz Chief Economic Advisor Mohamed El-Erian said Thursday.

Read MoreQE3 by the numbers

"Fact No. 1 is yes, QE is over in the U.S., but easy policy is not," he said. "Fact No. 2, QE may be over in the U.S., but there's going to be more QE in Europe and Japan. So, I don't think the QE trade is over. I think the QE trade is evolving."

On Wednesday, the U.S. central bank announced that it would end its $15 billion-per-month of bond buying.

On CNBC's "Halftime Report," El-Erian explained the evolution.

"So, the old trade was all about the Fed's ability to repress volatility across the board and boost up asset prices, and it worked very well," he said. "The new QE trade is about the multitrack world of central banking, so it's more on the currency."

El-Erian said he expected U.S. Treasury bond yields to trade between "2.20 to 2.60 because the economy is still weak and because the Fed will continue to give a signal."

Renewed strength in the U.S. dollar and renewed FX volatility would likely translate into other markets, he added.

Read MoreStock picks: 21 trades in 67 seconds

El-Erian also said he expected European Central Bank President Mario Draghi to make significant policy pronouncements.

"I think you're going to see quite a bit out of Draghi, not because it's going to be effective on the economy side but because he has no choice," he said. "The rest of the policy apparatus is pretty paralyzed."

El-Erian said quantitative easing was successful in "buying time for the economy to heal, buying time for Washington to get its act together. Washington hasn't gotten its act together, and therefore, looking forward there's going to be a lot of debate as to whether the costs and risks of QE offset the benefits or not. But it did buy time for the economy to heal, and that's important.

Read MoreUS shows torrid growth, boosted by defense, trade

"If you repress volatility and you tell investors not only is the Fed your best friend by repressing market volatility, but we are in a low-level Goldilocks on the economic front, markets will do what markets should do, which was they'll lever every risk factor. So, it's been great for markets, less good for Main Street."