When the financial crisis hit, it became clear how little people understood about personal finance. Negative amortization loans, teaser rates and fine print tripped up many homeowners. Yet the lack of basic budgeting skills needed to understand what one could reasonably afford in a monthly budget was a more fundamental problem.

Enter Finance Park as a way to teach kids how to manage their money as adults.

Tucked away in a 20,000 square foot white building behind a middle school in the center of Fairfax County, Virginia, Finance Park is a playground, of sorts—but one that's meant to give eighth graders a chance to be adults for a day by making basic budgeting decisions.

"When you really come down to it, it's about choices. It's about making the right choices that have financial implications," said Ed Grenier, the CEO of Junior Achievement of Greater Washington.

The structure is built like a mall, including 18 storefronts where students go for budgeting items, like housing, utilities, insurance and transportation. The environment is meant to be fun and engaging, but it's also built as a safe place to make financial mistakes.

Read MoreTo change bad habits, financial literacy push must go digital

'It definitely put things in perspective'

Junior Achievement, in partnership with local school systems, started Finance Park in 2010 and since then more than 56,000 students have gone through the program.

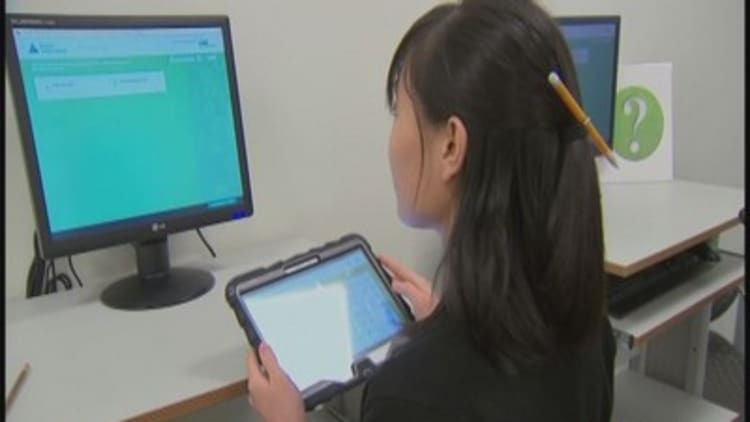

With support from Capital One and consulting firm KPMG, the curriculum has recently been updated to be tablet-based, and includes topics like student loan debt, child care and health care. Using tablets, math is calculated rather than using the old pencil and paper. Students are given a scenario on which to base economic decisions.

On a recent visit, eighth graders from Kilmer Middle School had a chance to play grownup for a day (The students' last names are withheld upon request).

Alexis, an aspiring chemist, lawyer or engineer, was disappointed to be given the scenario of a payroll clerk earning $32,000 a year. But the profile gave her an appreciation of the cost of basic needs like cable, child care, education and groceries. She marveled at the expense of having to spread her meager income around, saying: "I didn't realize you spend so much on simple things; that was really the most eye opening thing."

Rohan, a sharply dressed young man, was made a tax examiner, single with no kids earning $49,000 a year, which made him appreciate the decisions his parents make."You don't realize it until you see that they have to pay for health insurance, taxes, Internet, stuff like that," he said. "It definitely puts things in perspective."

Read MoreTeaching those who teach all things money

"It's a great way to teach the required content, basic economics of credit, savings, opportunity cost, things like that, as well as giving them a hands-on experience that is very relevant to them" said Alice Reilly, social studies coordinator for Fairfax County public schools.

Junior Achievement's Grenier said he hopes the lessons of the financial crisis aren't a fad, "spend less than you make, it's really that simple, think about the choices and their financial repercussions that your choices can have. If we can get students to walk out of this facility with that, I think we've accomplished a lot."