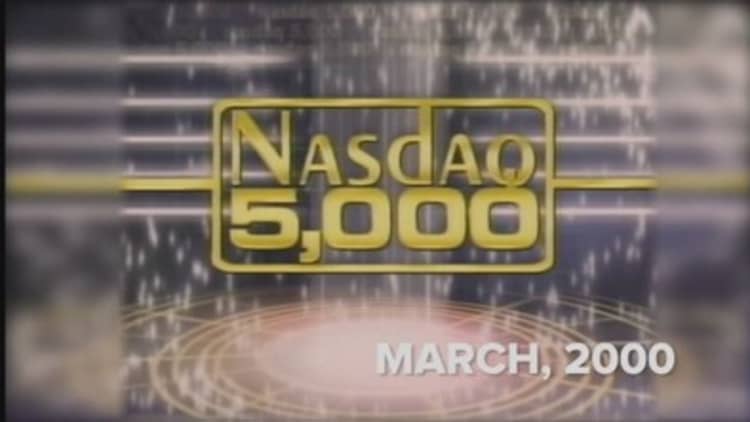

U.S. stocks closed higher on Monday, with the Nasdaq above the psychologically key level of 5,000 for the first time since March 2000 and the Dow and S&P 500 at records as investors cheered U.S. economic data and an interest rate cut in China.

"We've got economic data that continues to move things forward. I would much rather see 5,000 on improving economic data than the (conditions we had in March 2000)," said Art Hogan, chief market strategist at Wunderlich Securities.

The Nasdaq Composite last hit 5,000 during the tech bubble peak in March 2000. The index tumbled in the months following to land at 1,108.49 in October 2002.

Read MoreGross: Nasdaq 5K represents a bit of a bubble

The Nasdaq only closed above 5,000 twice before, once on March 9, 2000, and once on March 10, 2000.

"It is different this time," said Mark Spellman, portfolio manager at Alpine Funds. "Some of the companies are (reaching these levels) with earnings and cash flow."

Both the S&P 500 and Dow Jones industrial average also closed at new records.

Read MoreAs Nasdaq hits 5,000, is it time to worry?

Peter Boockvar, chief market analyst at The Lindsey Group, pointed out that "for perspective purposes, the 5,000 figure of course is a nominal level. In order to reach its inflation-adjusted peak, the Nasdaq will have to touch about 6,900, 38 percent above 5,000. The inflation-adjusted March 2000 S&P 500 high is about 2,075, which we're of course currently about at right now."

In economic news, the U.S. manufacturing sector had its best gains since October, according to Markit's final Manufacturing Purchasing Managers' Index that rose to 55.1 in February from 53.9 in January.

ISM Manufacturing for February was 52.9, its slowest pace in 13 months. Construction spending fell 1.1 percent in January.

Personal income increased of 0.3 percent, while personal spending fell 0.2 percent in January.

"All in all I think it's a reasonably good report (on the U.S. economy), even with the West Coast port shutdown, and the market is liking it," said Doug Cote, chief market strategist at Voya Investment Management.

The People's Bank of China (PBOC) cut benchmark interest rates by 25 basis points to 5.35 percent on Saturday—the second cut in three months—as deteriorating economic conditions forced the central bank to shorten the time gap between policy moves.

The HSBC/Markit Purchasing Managers' Index (PMI) for China climbed to 50.7 in February—the strongest level since July—from the contraction level of 49.7 in January, as overall new orders picked up. However, the survey indicated that manufacturing contracted significantly as the firms struggled to cope with erratic export demand and deflationary pressures.

"The news out of China cutting its benchmark interest rate and better-than-expected inflation news out of the euro zone are providing a lift to the U S market," Peter Cardillo, chief market economist at Rockwell Global Capital, said in a note. "However, it's the beginning of a very intense week of domestic economic data which we see steering the indices."

The big data point for the week is Friday's nonfarm payrolls report.

Besides the big jobs report, "I think the real movers in the market are going to be outside the United States," said Bryan Turley of MLV, referring to expected details on quantitative easing in Europe later this week.

Major U.S. Indexes

The Dow Jones Industrial Average closed up 155.9 points, or 0.86 percent, to 18,288.63, with Visa leading gains and IBM the greatest of four blue chip laggards.

The S&P 500 closed up 12.89 points, or 0.61 percent, to 2,117.39, with consumer discretionary leading eight sectors higher and utilities the greatest laggard.

The Nasdaq closed up 44.57, or 0.90 percent, to 5,008.10, the third time in history the index has ended above that psychologically key level.

The U.S. 10-year Treasury yield traded near 2.08 percent. The U.S. dollar held higher against major world currencies.

Three stocks advanced for every two decliners on the New York Stock Exchange with an exchange volume of about 756 million and a composite volume of 3.4 billion in the close.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded just below 13.

In corporate news, HP announced on Monday it will acquire Aruba Networks for approximately $3 billion.

Over the weekend, NXP announced it is buying rival Freescale Semiconductor for about $11.8 billion in cash and stock, a deal valued at $40 billion total. Freescale stockholders will receive $6.25 per share in cash and 0.3521 NXP shares for each share they now hold.

"Look for other names in those (M&A) sectors to trade up in sympathy," Hogan said.

Costco announced a new credit card program agreement with Citi, supported by Visa's network. The warehouse retailer failed to renew terms with American Express after a 16-year partnership.

Trading in Lumber Liquidators was temporarily halted Monday morning after CBS' "60 Minutes" reported that the company sold than permitted under California's health and safety standards.

Sotheby's reported adjusted earnings of $1.12 that missed estimates on revenue of $351.2 million that beat expectations.

Companies reporting after the bell include Mylan Labs, Palo Alto Networks and Salix Pharma.

Berkshire Hathaway is in focus following the release of Warren Buffett's annual investment letter and the company's latest earnings. Those numbers did fall short of estimates, and Buffett said it was likely that although Berkshire would outperform other companies in the future, its size may make it impossible to equal past gains.

Asian markets were trading higher Monday following the move to stimulate the world's second largest economy.

Read MoreEarly movers: BRK.B, AAPL, LL, CAH, BSX & more

In Europe, stocks turned lower with oil prices. Earlier, investors cheered data showing that deflation in the euro zone eased in February while the rate of unemployment fell in January.

Crude oil futures settled down 17 cents at $49.59 a barrel on the New York Mercantile Exchange. Gold settled down $4.90 at $1,208.20 an ounce.

—CNBC.com contributed to this report.

On tap this week:

Monday

Mobile World Congress

Earnings: Mylan Labs, Palo Alto Networks, Salix Pharmaceuticals, Caesars Entertainment

Tuesday

Auto Sales

Earnings: Bank of Nova Scotia, Barclays, AutoZone, Best Buy, Dick's Sporting Goods, Smith & Wesson, TiVo

Wednesday

Earnings: Brown-Forman, Abercrombie & Fitch, H&R Block, PetSmart

7 a.m.: Mortgage Applications

8:15 a.m.: ADP Employment Report

9:45 a.m.: PMI Services Index

10 a.m.: ISM Non-manufacturing Index

10:30 a.m.: Oil inventories

2 p.m.: Beige Book

Thursday

Chain store sales

ECB Governing Council Press Conference

Earnings: Costco, Canadian Natural Resources, Kroger, JoyGlobal, Cooper Cos., Diamond Foods, Finisar, Quiksilver

7:30 a.m.: Challenger Job-Cut Report

8:30 a.m.: Jobless claims

8:30 a.m.: Productivity & Costs

10 a.m.: Factory orders

10:30 a.m.: Natural gas inventories

4:30 p.m.: Fed balance sheet/Money supply

Friday

Weekly rig count

Earnings: Foot Locker, Staples

8:30 a.m.: Nonfarm payrolls

8:30 a.m.: International trade

3 p.m.: Consumer credit

More From CNBC.com: