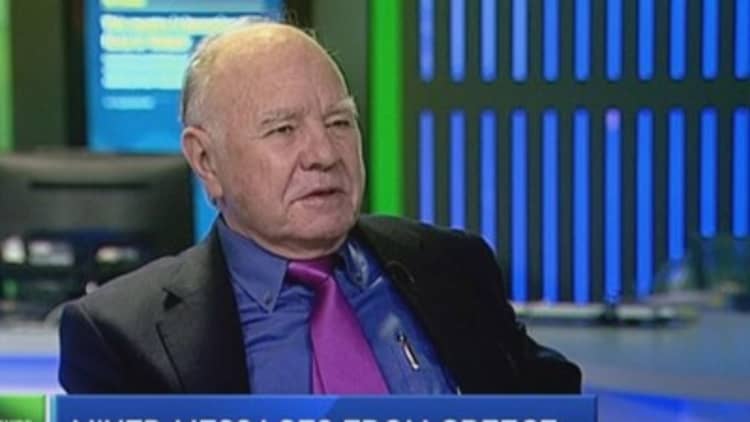

Greece is bankrupt and should default, well-known investor Marc Faber told CNBC Friday, arguing that a "geopolitical game of chess" was being played out in the region.

The comments by Faber, the editor of the "Gloom, Boom & Doom Report," came at a time of heightened tensions between Greece and its international creditors.

The organizations overseeing the country's two international bailouts -- worth a combined 240 billion euros ($259 billion) -- have said the country will not receive a last tranche of aid, worth 7.2 billion euros, until it makes far-reaching reforms.

But Faber, a bearish investor known as "Dr. Doom," said the country's fiscal situation was unsalvageable.

"Even if Greece grows at 10 percent per annum for the next ten years, it will not be able to pay its debts back," he told CNBC.

"It's bankrupt. We better face the reality and not kick the can the can down the road. Greece should default." (Tweet this)

Read MoreGreek protests as Varoufakis strikes defiant tone

Faber said that while Greece could leave the euro zone and adopt a parallel currency, there that geopolitics were coming in to play and there was no appetite in Europe to let the country exit from the single currency bloc.

"I personally think it's not so much of an economic issue as a political issue," he told CNBC Europe's "Squawk Box."

"Europe, and in particular NATO (the North Atlantic Treaty Organization military alliance), and the U.S. do not want Greece to leave (the euro zone) because if they do, other people are going to knock on Greece's door -- like the Russians or the Chinese maybe. It's very much a geopolitical game of chess that's being played."

Greece and its creditors disagree on which reforms should be implemented, however, and as such the much-needed aid remains under lock and key. This has prompted speculation that the country could soon run out of money and default on its forthcoming debt repayments to the IMF and ECB, which could, in turn, result in the country leaving the euro zone.

Read MoreWhat would a Greek default look like?

Greece denies this is the case and ECB President Mario Draghi said earlier this week that he has not even considered a default. On Friday, Greek Finance Minister Yanis Varoufakis will meet Draghi and IMF officials in Washington.

The ECB stands to lose a lot if Greece does default, Faber argued, and thus Greece was in strong position to negotiate better terms for its bailout program and debt repayments.

"I think that the ECB and European banks will have to take huge losses on their loans to Greece and bond purchases they have made (if it defaults)," he said. "I think Greece is in a very strong negotiating position. If they don't want to pay what are you going to do, invade and hang them all up?"

- By CNBC's Holly Ellyatt, follow her on Twitter @HollyEllyatt. Follow us on Twitter: @CNBCWorld