Many Obamacare customers could be looking at surprisingly large price increases next year—if insurers get their wishes.

Health insurance premiums for individual plans in major U.S. cities would rise by an average of 12 percent in 2016 if the newly proposed prices are approved, a new analysis finds.

And prices would increase even more—14 percent on average—for people enrolled in the most popular type of Obamacare plans, known as "silver" plans, the HealthPocket study reveals.

Customers insured in health maintenance organization (HMO) and exclusive provider organization (EPO) plans—which as a rule don't cover treatment from providers outside of their networks—would be facing average increases that are higher still—20 percent for HMO plans and 18 percent for EPO plans.

Bigger-than-expected rate hikes

"Given the rate of general inflation in the country, and the economic situation, the rate increases were surprising to us," said Kev Coleman, head of research and data at HealthPocket, a health-plan comparison tech company.

"I was expecting somewhere between the 6 to 8 percent range," said Coleman, whose company looked at proposed rates in and around the largest cities in 45 states for a 40-year-old nonsmoker.

HealthPocket's analysis comes on the heels of the federal government releasing information about only those insurers who are asking for price increases of 10 percent or more. The company looked at rate filing requests for all insurers in the major cities, not just those who want double-digit hikes.

The proposed prices, if approved, will come as a shock to the millions of Obamacare customers who pay the full retail price for their plans since they are ineligible for subsides that offset the cost of insurance for those with low and moderate incomes, Coleman said.

Read More10 drugs to hit fed budget by $50B over decade

"I think they're going to be frustrated," Coleman said. "We tend to forget that millions of people are unsubsidized ... these people are paying full freight."

On the other hand, about 8.7 million people currently receive federal subsidies worth an average of $272 per month to reduce the cost of their monthly premiums, a fact the Obama administration often cites when touting the benefits of the Affordable Care Act. For those people, the proposed price hikes, if approved, would weigh less heavily in absolute dollar terms.

This is really the first time that America's really seeing true Affordable Care Act rates.Kev Coleman, HealthPocket's head of research and data

And not all nonsubsidized customers in the U.S. would necessarily face double-digit increases. Actual prices will depend on an individual's age and location.

There is also likely to be a downward adjustment in some rate proposals before they are finalized this fall. In New York state, for example, Coleman noted that insurers for 2015 had asked for average price hikes of 13 percent, but ended up getting approved for less than half of that, 5.7 percent. This year, insurers in New York are asking for a 13.5 percent increase.

'True' Obamacare rates

The proposed price hikes that HealthPocket studied come as insurers, for the first time, have a fuller understanding about how health benefits are being used by Obamacare customers. That usage data are being factored into their price proposals as they seek to balance their desire for enrollment against the costs of insuring their customers.

Before 2014, when the first Obamacare prices were set, insurers had no such data about how benefits would be used, and there was pressure to keep prices attractive to lure customers to the new government-run exchanges.

When insurers proposed prices for 2015, there was very little, if any, helpful data because their recommended prices had to be submitted just months after most people had enrolled for 2014. There was also a 25 percent increase in the number of insurers in the Obamacare market in 2015, which helped keep prices competitive. For 2016, there isn't a similar large influx.

"This is really the first time that America's really seeing true Affordable Care Act rates," Coleman said.

CNBC last week revealed how one big insurer, Blue Cross Blue Shield of Texas, was asking for average rate hikes of nearly 20 percent for its Obamacare-compliant plans. In its rate filing, BCBS cited the fact that it had suffered a loss of as much as $400 million from covering customers in those plans.

Not all insurers are proposing rate hikes that steep. But HealthPocket's analysis reveals that double-digit proposed increases are more the norm in many population-heavy areas of the country than not.

The analysis found that a hypothetical 40-year-old nonsmoker enrolled in an Obamacare silver plan would be looking at an average proposed rate of $389.49 per month next year, compared to the average $341 she pays now, HealthPocket found.

Read More

Silver plans are, by far, the most popular type purchased on government-run exchanges such as HealthCare.gov, with 67 percent of all customers enrolled in such plans.

In silver plans, insurers pay 70 percent of the covered medical benefits of their customers, with enrollees paying the balance in the form of out-of-pocket costs such as copayments and deductibles.

Cheapest, priciest plans see lowest hikes

Proposed price increases for bronze plans are lower, on average. About 22 percent of exchange customers are enrolled in bronze plans, which are the second most-popular type and tend to be the least expensive. In these plans, about 60 percent of benefits are covered.

HealthPocket found that a nonsmoker enrolled in a "bronze" Obamacare plan would be faced with average prices rising 9 percent from $292 per month this year to $319.04. The rate increases would be even lower, 4 percent on average, for people enrolled in a preferred provider organization bronze plan, where customers pay less if they visit doctors in their network. But people in PPO bronze plans already pay $319.06 per month on average this year, and would see those rates rise to $331.48 next year.

The hypothetical customers in a gold plan, which pays 80 percent of covered benefits, would see rates rise an average of 16 percent, from $397.65 per month now, to $459.34 next year, HealthPocket found. Just 7 percent of Obamacare exchange enrollments came from gold plans.

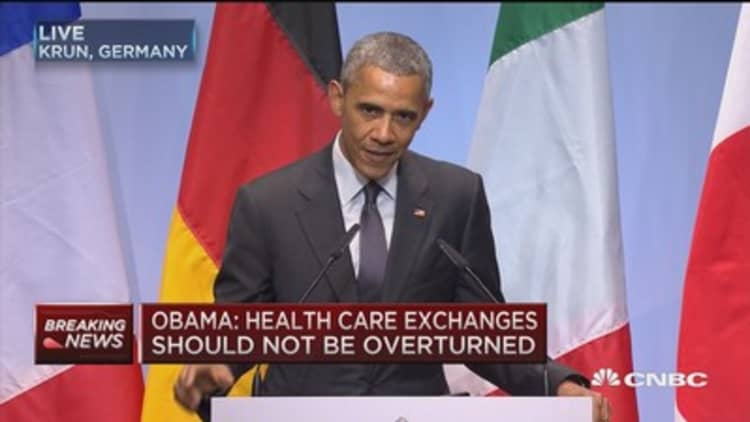

Read MoreObama touts health law as ruling looms

The least popular plans, which are also the priciest, platinum plans, would see the lowest average hike. Platinum prices are proposed to rise an average of just 6 percent, going from $525.39 per month to $558.62 per month next year, HealthPocket found. Only 3 percent of enrollees are in platinum plans, which pay for 90 percent of covered benefits.

In a surprising twist, HealthPocket found the biggest proposed percentage increases were in HMO and EPO plans.

Coleman said that finding was "really confusing," because HMOs and EPOs, by design, are intended to hold down costs by restricting covered benefits in all but emergencies to medical providers in their network, where providers agree to accept set payments in exchange for the business.

Supreme Court threat

Coleman said that while he was surprised by that finding, and by the overall average proposed increases, these numbers will seem small if the Supreme Court rules this month that subsidies cannot be given to Obamacare customers who buy insurance in 34 states served by HealthCare.gov, the federal exchange. The high court is considering arguments from plaintiffs who claim that only customers of state-run marketplaces can get such financial aid.

If the subsidies are taken away in HealthCare.gov states, "you'll have incredible increases in health insurance rates," Coleman said.

That's because insurers are expected to face a massive exodus of subsidized customers from their plans, particularly by people who cannot afford to pay the full retail price or whose health is good enough that they are willing to go without insurance at the nondiscounted price. Without such customers balancing out sicker, older customers, insurers will have to raise their premium prices to cover costs by as much as 50 percent in the affected states, analysts say.

Even without such increases, customers who currently receive subsidies would face premiums that are in many cases hundreds of percentage points higher if they are compelled to pay the full price.