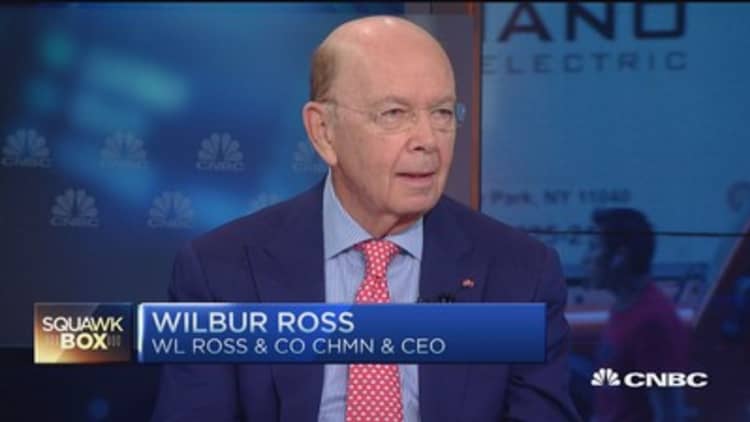

The deteriorating situation in Greece—including long lines and a 60 euro ($67) limit at ATMs—could get much worse if voters there refuse to accept creditor-imposed reforms in a referendum this coming Sunday, said billionaire Wilbur Ross, who has a large interest in the country.

"Once there's social unrest, which there will be before too long if this thing continues, no tourist is going to want to go to [Greece]," Ross told CNBC's "Squawk Box" on Monday. "If the Greek people understand how limited those concessions that are requested are, and contemplate going into the abyss on other side, they're never going to pick the abyss."

Read MoreGrexit a tragedy, but 'Apocalypse Not': Strategist

Last year, the chairman and CEO of WL Ross & Co. and other international financiers invested $1.8 billion in Eurobank—becoming the biggest shareholder of Greece's third-largest bank. He said Monday he made the bet thinking the current government would not be in power.

Ross said there are lines at Eurobank branches, but surprisingly they're "not totally out of control yet."

Read MoreEuro turns positive vs dollar despite Greek drama

Debt talks between Greece and its creditors collapsed late Friday, after Greek Prime Minister Alexis Tsipras announced a national vote for his people to decide on whether they're willing to accept reforms in exchange for more bailout aid. Sunday's referendum may effectively turn out to be a vote on whether Greece stays in the common currency.

"I don't see how Mr. Tsipras and the [leftist] Syriza party survives this. They promised people right along that they could get no problems, go back to the way it was, the EU would fold. The EU didn't fold and I don't think they will fold," Ross said.

Tsipras actually negotiated a lot of concessions from the European Union and should have stopped and declared victory, he argued, though acknowledged the leader's party would have never approved.

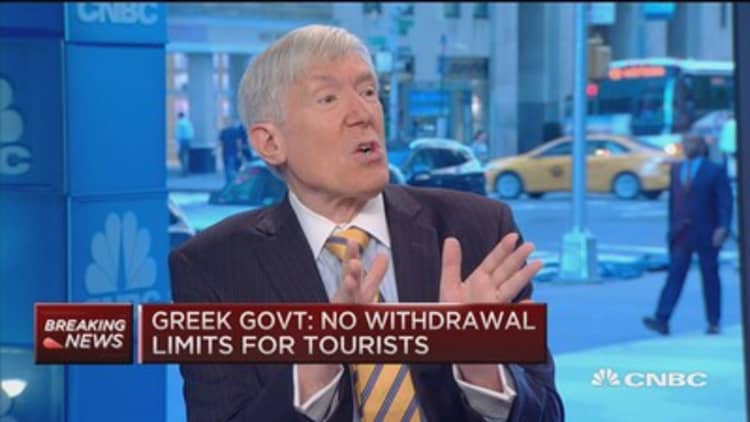

"If they vote 'no,' then the kind of chaos we've seen today will compound," Robert Hormats, former Goldman Sachs international vice chairman, said Monday in a separate CNBC interview.

In advance of Sunday's vote, Greek banks and the stock market there will remain closed.

The Greek people have to make the decision, said Hormats, also a former undersecretary of state for economic growth during Hillary Clinton's tenure leading the department. "Do they want more of this chaos or do they want to take the kind of cuts that the creditors are asking them to take," he said.

Tsipras should have called for a vote earlier to avoid all this disruption, Hormats said.

The European Central Bank, which refused to raise emergency funding for Greek banks, wants the people of Greece to understand that if the creditor-imposed program is voted down, "they're not going to get any more money and they're not going to be part of the euro," said the vice chairman of international consultancy Kissinger Associates, adding most Greeks don't want to exit the common currency.

Read MoreOp-ed: The 4 Horsemen of the stock Apocalypse?

No matter what happens, Hormats predicted there will be little chance of major contagion because Europe has taken the steps over the years to insulate a Greece exit from the euro.

Ross said it's ironic that "Greece bought us democracy centuries ago, and now they're about to bring us chaos."