The precipitous plunge in Chinese stocks, and Beijing's struggle to halt the fall, has sent waves of panic through the country's 90 million-plus retail investors, who say their life-savings are "falling into an abyss."

At a Citic Securities brokerage in Beijing on Wednesday, the trading hall was packed with retail investors, many of them pensioners, lamenting the loss of the money in the stock market. One investor was watching the big screen between his fingers as if at a horror flick.

The mood was fearful, panicked and sometimes hostile, as investors huddled around computer screens, waiting to see whether the latest moves by Chinese authorities to prop up the stock market would do any good.

"The government has been manipulating the stock market all this time," one investor who didn't want to be named told CNBC. "The authorities made us believe that we can make money from a bull market but actually we are falling into an abyss losing most of our life savings."

Another questioned the government's motives.

"I'm sure if the Chinese Communist Party is really determined to rescue the market, they could turn it around overnight. They haven't used their most powerful tools. Why? There must be disagreement among the leadership."

On Wednesday Beijing eased rules for insurers to invest in blue-chips stocks, raised margin requirements for short positions against small-cap stocks and warned against "irrational selling", among other initiatives.

More than half of listed companies in China's market have now halted trading in their shares, essentially locking up investors' cash in suspended stocks - a big talking point at the trading hall.

At a different broker's office in Beijing, Liang Shuang said he had invested $100,000 into the market and lost at least third of his investment. He said: "The stock market is like a casino. But in a real casino you know the rules of the game."

In the rural village of Nanliu two hours drive outside of Xian, villagers huddled around a mini stock exchange center watching their portfolios shrink with much dismay.

Farmer Liu Jianguo said, "I have lost confidence in the market. I'm waiting desperately to see if my stocks will return to the level where I bought them. It looks as though the government has done quite a lot but the impact is limited."

And there is a lot of dark humor on social media about the stock market plunge. One writer posted a wanted poster of a bull saying "Where is the bull?"

The term "Plunge in Shanghai Composite" made it to the top 50 search topics on China's Twitter-like platform Weibo, ranking in 4th place early Wednesday.

Beijing-based entrepreneur Xue Yuxi, who has been an active investor in Shanghai and Shenzhen stocks since 2010, believes there is little the government can do to turnaround sentiment at this point.

"The government wants to revive the stock market, however investors have already lost faith. Even if the market shows positive signs, it will no longer gain back much confidence and attention like before," Xue, who is in his mid-20s, told CNBC.

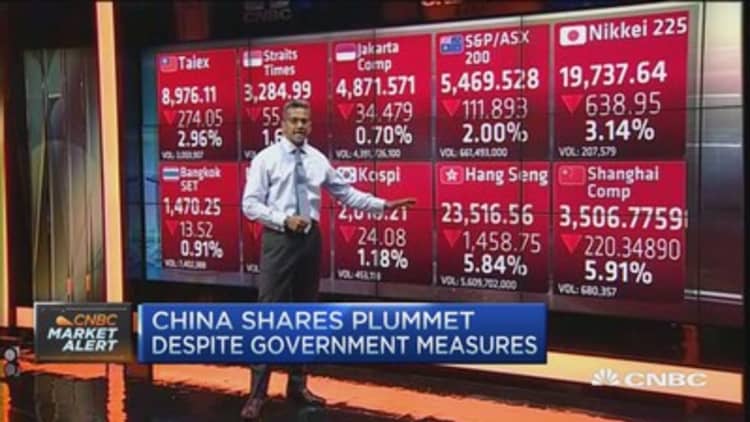

The benchmark plummeted as much as 8 percent in early trade, sliding further into bear market territory, before closing down 6 percent. The index is down over 30 percent since hitting a seven-year peak of 5,166.35 on June 12. Meanwhile, China's securities regulator warned of a "panic sentiment" gripping the market, that was causing "irrational selling".

Responding to the market's wild swings early on Wednesday, Xue said, "I feel numb. It has become a norm for me. "

He is one of many investors disillusioned by local equities. According to a recent survey by the China Household Finance Survey Center, a rising number of mainland investors are preparing to pare back their equity investments.

Almost one third, or 32 percent, of the 28,140 respondents said they planned to reduce holdings in the country's stock markets in the coming quarter. Among them, 4.8 percent indicated they would divert their investments into the property sector, compared to 2.3 percent when the survey was last conducted three months ago.

Only 12.3 percent of the respondents said they would increase their share investments, while the remaining 56.2 percent prefer to maintain the status quo. The quarterly survey was conducted between June 15 and July 2.

Parallels to Greece?

China regulators warn of 'panic sentiment'

Experts said that the decision by regulators to allow the mass filing of trading halt requests had likely worsened the so-called irrational selling being seen now.

"A lot of investors have money tied up in these shares. There's deep unease because now they don't have access to their money. This is like exactly what Greek banks are doing by limiting the amount of cash depositors can withdraw every day," said Shaun Rein, founder and managing director of the China Market Research.

"This is the fastest way to destroy credibility in the financial system. Regulators ought to be fired for causing this much panic," he added.

Permitting hundreds of companies to suspend trading had magnified selling in quality stocks as mutual funds scrambled to liquidate positions to meet redemption claims, said Hao Hong, managing director of research and chief strategist at Bank of Communications International.

"The situation is getting into a negative feedback loop," he said. "People are selling everything they can, anything that has liquidity. They are afraid later on they won't be able to get buying orders in the market."

Rules of the game

With market in meltdown mode, it would take a lot to change the perception of investors, said Hong.

"Chinese authorities need a concrete, step-by-step market rescue plan. At the moment, they are changing the rules as the play the game," he added. "If I was in the market, I wouldn't know what new rules they are going to introduce – they must provide an open, transparent and fair trading environment for price discovery."

Rein agreed there is little that could be done to revive confidence at the moment.

"There's a bit of shell shock," he said, adding that wealthier investors that have managed to exit the market were likely to park their cash in real estate in first-tier cities amid a lack of options.

- Additional reporting by Wendy Min and See Kit Tang