U.S. stocks closed higher Friday, wrapping up a solid week of gains, as investors digested indications from the Fed on the timing of a rate hike ahead of earnings season. (Tweet This)

"The (Fed) minutes from yesterday sort of confirmed that the Fed is likely on hold for a while and now it's a matter of people repositioning themselves, trying to protect their investments," said Robert Pavlik, chief market strategist at Boston Private Wealth.

"Now you have this earnings season that's going to be a bump in the road," he said.

The major averages closed mildly higher after earlier falling into negative territory.

The S&P 500 closed up 3.26 percent for the week, its best since the week ended Dec. 19, 2014. The Dow Jones industrial average closed up 3.7 percent for the week, its second-best week of the year so far.

The Dow transports closed 0.75 percent higher after briefly rising more than 1 percent, continuing to hold above their 50-day moving average as airlines led most constituents higher. The transports ended the week up 4.8 percent, their best since October 2014.

Apple closed 2.4 percent higher, while the iShares Nasdaq Biotechnology ETF (IBB) ended up 0.4 percent on the day.

Read MoreApple hired the Tesla engineers we fired: Elon Musk

The energy sector declined 0.7 percent as the greatest laggard in the S&P 500. The sector posted gains of 7.77 percent for the week, its best since December 2014.

In oil markets, U.S. crude settled up 20 cents at $49.63 a barrel, up more than 8 percent for the week. Brent crude gave up gains to hold below $53 a barrel in afternoon trade.

The U.S. oil rig count dropped for the sixth straight week, down 9.

Stocks rallied Thursday, with the S&P 500 and Dow Jones industrial average closing above the psychologically key levels of 2,000 and 17,000, respectively, for the first time since August.

The three major averages remained within 10 percent of their 52-week highs, or out of correction territory. The Russell 2000 closed above its 50-day moving average but remained in correction mode, off a touch more than 10 percent from its 52-week high.

"It's a quiet end to a fairly busy week, particularly in monetary policy. Fed speeches are keeping markets in limbo," said Ryan Sweet, director of real-time economics at Moody's Analytics.

"You have a lot of mixed messages on the future of monetary policy from the Fed," he said.

Read MoreRate hike timing anxiety keeps traders on edge

The September Fed meeting minutes released Thursday afternoon indicated policymakers were concerned about reaching their inflation target of 2 percent and the impact of the global economic slowdown. The minutes said policymakers don't expect to reach their inflation goal before the end of 2018.

Market sentiment increasingly expects a rate hike to come no earlier than the first few months of 2016, although liftoff later this year is still possible.

"The FOMC minutes actually shocked a lot of market participants that (policymakers) were a lot further away from raising rates in September than many believed," said John Caruso, senior market strategist at RJO Futures.

Read MoreThe Fed is showing that the market matters most

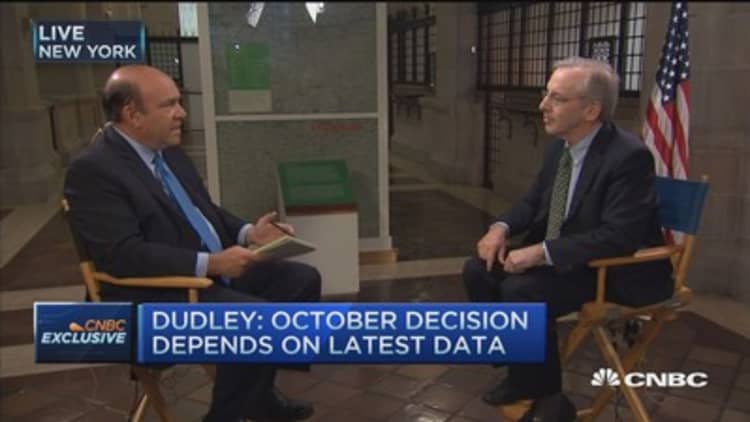

New York Fed President William Dudley said on CNBC that the "international developments in August and financial developments in August raised some questions about the strength of the global outlook" and how that would affect the U.S. economy.

Atlanta Fed President Dennis Lockhart said in a Reuters report Friday morning that a U.S. interest despite some conflicting economic signals, reinforcing the central bank's message.

Separately, the Chicago Fed's Charles , not the timing of liftoff, Reuters reported. Evans has long called for deferring a rate hike to next year.

On the data front, import prices fell 0.1 percent in September, less than the expected 0.5 percent drop. However, export prices fell 0.7 percent, more than the 0.2 percent forecast by economists.

showed a 0.1 percent increase in inventories, while wholesale sales declined 1 percent.

Treasury yields initially spiked before coming off slightly highs, with the 10-year at 2.09 percent and the 2-year at 0.64 percent in the close.

The U.S. dollar traded half a percent lower against major world currencies, with the euro near $1.136 and the yen at 120.26 yen against the greenback.

Read MoreEarly movers: AA, ASNA, SEAS, LLY, WFC, TSLA, AAPL & more

Investors also digested Thursday's news that House Majority Leader Kevin McCarthy pulled out of the race for House speaker, adding uncertainty to congressional leadership ahead of key budget negotiations.

"That's obviously creating some near-term uncertainty," said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management.

"We know we're in a leadership gap in the house and we're approaching a debt ceiling deadline," he said.

However, that deadline is still several weeks away.

"I don't think the market's really paying that much attention to it right now," Pavlik said. "The potential for that becoming more of an issue is still more down the road. I think it's earnings first."

Earnings season gets underway with JPMorgan results next Tuesday. Alcoa reported earnings after the close Thursday that missed on both the top and bottom line.

No significant earnings were expected Friday.

Major U.S. Indexes

In Europe, the pan-European Stoxx 600 index closed mildly higher. Glencore closed up 7 percent after it cut about a third of its annual zinc output due to low prices.

Japan's Nikkei finished 1.6 percent higher while the Shanghai Composite closed 1.3 percent higher.

The Dow Jones Industrial Average closed up 33.74 points, or 0.20 percent, at 17,084.49, with UnitedHealth leading advancers and Intel the greatest laggard. DuPont was the greatest gainer on the week, while Nike was the only decliner for the week.

The closed up 1.46 points, or 0.07 percent, at 2,014.89, with information technology leading five sectors higher and energy the greatest laggard. All sectors gained for the week, with energy the best performer.

The Nasdaq closed up 19.68 points, or 0.41 percent, at 4,830.47.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, held near 17.

About nine stocks advanced for every seven decliners on the New York Stock Exchange, with an exchange volume of 921 million and a composite volume of 3.7 billion in the close.

High-frequency trading accounted for 49 percent of this month's daily trading volume of about 7.9 billion shares, according to TABB Group. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

Gold futures settled up $11.60 at $1,155.90 an ounce.

Correction: An earlier version of this story misstated the month since the S&P 500 posted its best week. It was December 2014.