U.S. oil prices fell about 3 percent on Friday as the U.S. rig count rose for the second straight week and as a strong dollar again weighed on demand for crude futures.

A slide in equity prices on Wall Street also pressured futures of Brent and U.S. crude's West Texas Intermediate (WTI).

The number of rigs operating in U.S. fields rose by 3 to 328 in the previous week, oilfield services firm Baker Hughes reported. At this time last year, drillers had 635 rigs online.

More sabotage of Nigeria's oil industry by rebels had limited losses in Brent and WTI earlier in the session. The Niger Delta Avengers group blew up the Obi Obi Brass trunk line for oil run by ENI, adding to the woes of Africa's largest oil economy.

International Brent crude oil futures fell $1.43, or 2.8 percent, to $50.52 per barrel. U.S. West Texas Intermediate (WTI) futures settled 2.9 percent lower, or $1.49, at $49.07.

Baker Hughes said last week U.S. oil drillers added 9 rigs in the week to June 3, bringing the count up to 325, as oil prices traded above or near $50. Prior to that, drillers cut on average 10 oil rigs per week this year, after reducing on average 18 rigs per week last year, on worries of oversupply.

"Today's oil rig count could exert a price impact with any increase," said Jim Ritterbusch of Chicago-based oil markets consultancy Ritterbusch & Associates, citing concerns that the decline in U.S. crude production may be abating.

Analysts said that a rebound in the dollar had dented oil prices by making fuel imports for countries using other currencies more expensive.

The dollar index was up nearly 0.8 a percent, adding to the weight on oil, as jittery global financial markets sent investors towards safe haven currencies.

However, strong overall demand for oil especially from refineries, as well as supply disruptions, were helping to keep prices from falling faster and further.

"Despite falling slightly overnight, the outlook for oil (prices) remains positive, which should keep the recent upward trend intact," ANZ added.

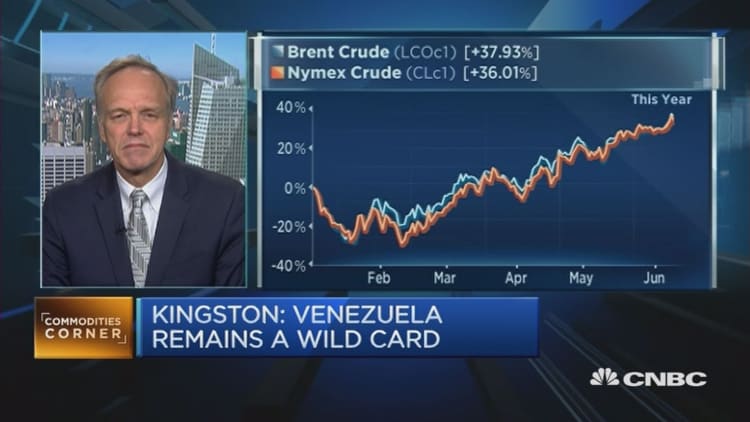

Crude prices have virtually doubled since touching their lowest in more than a decade in early 2016 as strong demand and supply disruptions erode a glut that pulled down prices by as much as 70 percent from a mid-2014 peak.

Market rebalancing is ongoing. On the demand side, global refining activity is about to hit its highest on record just as crude supply disruptions around the world tighten the market.

Data in Thomson Reuters Eikon shows that currently available global refining capacity will reach 101.8 million barrels per day (bpd) in August, its highest on record, and up from around 97.25 million bpd in March.

Of the available capacity, investment bank Jefferies said on Friday that U.S. refinery utilization alone reached 90.9 percent in the first week of June.

Traders said this means producers need to pump every barrel of crude they can to meet refinery demand, and that the supply disruptions around the world - from Canadian wildfires, sabotage in Nigeria, and output cuts in the United States, Venezuela and Asia - will tighten the market and eat into inventories.

Yet the strong refinery output could end as fast as it came as the reserve capacity, the difference between available and installed capacity, is about to fall below half a million bpd, the tightest since late 2013, the data shows.

"Refining output, and by extension crude demand, can basically only go down as facilities either go into unplanned outage or refinery runs are cut to reduce an emerging product glut," said one trader in Singapore.