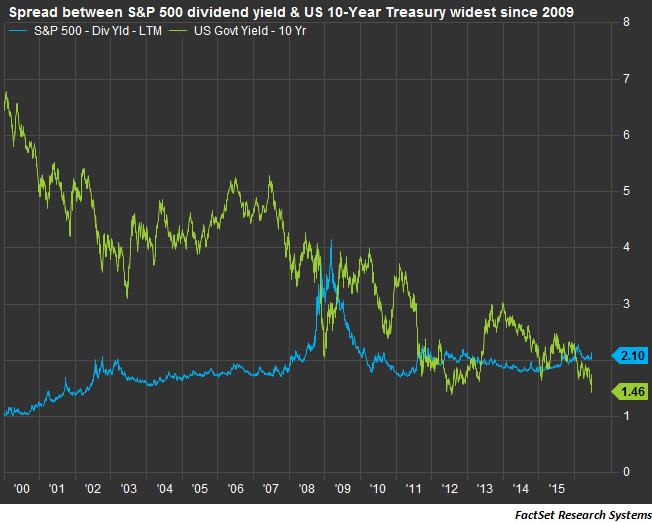

The sharp sell-off in equities and falling bond yields following the U.K. referendum have pushed the spread between the S&P 500 dividend yield and the US 10-year Treasury to levels not seen since the housing crisis of 2009.

The S&P 500 dividend yield also pushed above the 10-year Treasury yield in 2009 and 2012, reversing a more than 40-year trend. As of Wednesday morning, the S&P 500 dividend paid almost 0.64 percentage points above that of U.S. 10-year Treasury.

A positive spread is considered bullish for equities because investors can expect to receive more in payments from owning the S&P 500 index than they could from Treasurys.

The dividend yield currently is at 2.1 percent and has stayed above 2 percent for most of the year. That's a 0.17 point increase from the same period last year.