The online-education stocks that Cramer has liked so much are up big. Actually, a lot of people have liked them, and that’s why Apollo Group , Career Education , Corinthian Colleges , ITT Educational and others are doing so well. The reason is obvious enough: This group offers one of the market’s only secular growth opportunities. And as a result, investors have rushed in, making these guys the big men on campus.

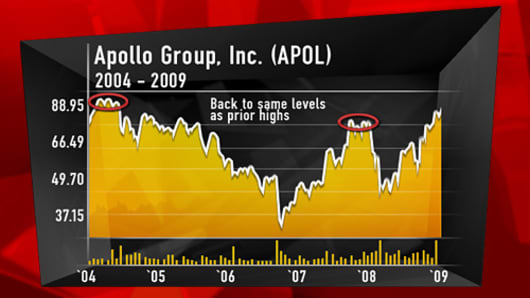

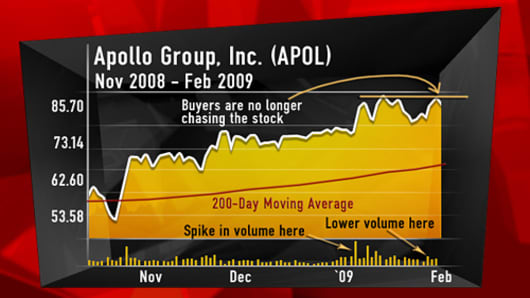

But Cramer wondered if the Internet schools have ramped up too much. Is it time to take profits and put these companies in the Sell Block? Technical analysts seem to think so. They say Apollo Group’s chart (see below) is looking “toppy.” That’s jargon for a “double top” in the stock, creating what looks like an M. While heavy volume created the first high, fewer buyers took part in the second. And to chartists, volume is everything. It separates real moves from the fake. That second high, called a “flat top,” shows a decline in aggressive buyers. The only people left are either late to the party or not wealthy enough to buy more Apollo. Either way the stock can’t break through its previous high.

Put simply, there’s no one left to buy APOL. The share price is too expensive for value investors, and the momentum buyers that pushed the stock up are cashing out. In technical analyst parlance, the buyers are exhausted. This is happening in all the online-education stocks, not just Apollo Group. (And Cramer favorite Terra Nitrogen, which is up 40% since his Nov. 3 recommendation.) So it’s time to sell.

The only problem Cramer has with this reasoning, though, is that technicians would say APOL’s a buy if it breaks out and jumps to $89 or $90. That new high, they say, would show renewed momentum interest and eliminate the “topiness,” if you will, of the chart. What Cramer can’t understand is why a stock sold at $85 is suddenly a buy at $90. To him, that sounds like buy high, sell low.

Cramer, of course, has always favored the fundamentals. He prefers to judge a stock according to its underlying business and macroeconomic factors such as inflation and unemployment, rather than a performance chart. But technical analysis holds sway over some of Wall Street’s biggest money managers, so the discipline can’t be ignored. Investors have to pay attention to this trading school if they want an accurate picture of the market. Because these guys move stock prices.

The fundies largely agree with the technicals in that at least some profits need to be taken. The growth expectations for online education are already baked into the stock, Cramer said, and as we mentioned, this group isn’t exactly Wall Street’s best-kept secret. So the valuations are right, if not a bit high. That might explain all the insider selling. Executives at both Apollo Group and Lincoln Educational Services have been dumping shares on the open market. And if they’re getting out, maybe other investors should, too.

A basket of 10 education stocks is up 22% over the past 12 months, while the S&P 500 is down 37% and the Dow’s lost 34%. Full-year earnings estimates for eight of the 10 have been revised upward in the past 90 days. The average price-to-earnings multiple is 28.9. After the dot-com bust and during the recession that followed, the average P/E was 30.4. Apollo’s multiple may have been as high as 41, and it’s only trading at 24 now, but there’s a lot more competition these days than there was back then. So Cramer thinks there might be little upside left in these stocks.

There are some keepers, though. American Public Education is performing well thanks to its military-focused programs. Eighty percent of its student body is either military or military related. The stock’s up just about 7% since Cramer’s Jan. 9 call, and he thinks APEI is still a buy. The rest of this cohort – COCO, CECO, ESI – are up 20%, though, and those should be sold.

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the Mad Money website? madcap@cnbc.com