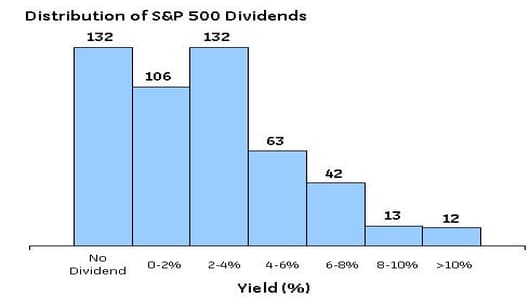

Between stocks rallying and recent dividend cuts by companies like GE and Alcoa , average dividend yields in the S&P 500 have fallen. A review of the market benchmark reveals that about 26% of its components have a dividend yield between 3 to 6 percent. The average dividend yield for these companies now stands at 3.89%, while the median is at 3.12%.

The following chart portrays the distribution of all the companies in the S&P 500, according to their corresponding dividend yields. The chart skews to the left, with fewer companies driving up the overall average. In addition, approximately a quarter of all the companies within the S&P 500 do not pay a dividend.

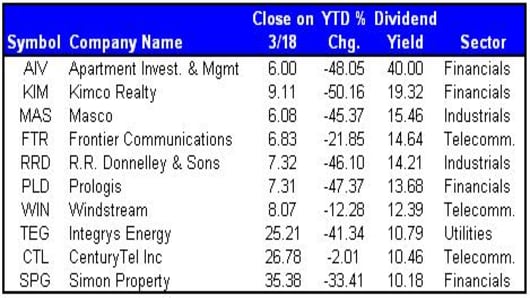

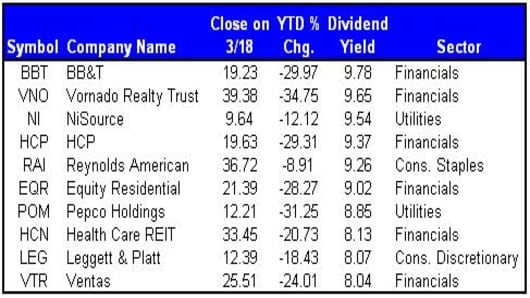

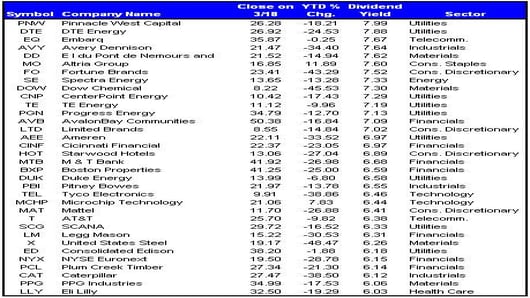

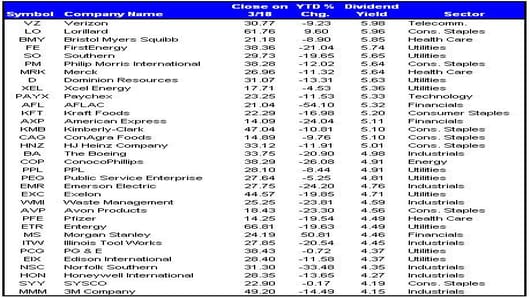

The tables on the next few pages depict some of the companies in the S&P 500 with dividend yields north of 4%. The yields on these companies are based on the most recent data from Thomson Reuters. The dividend yields of these companies could change, as was the case with Alcoa's announcement on Monday that it was reducing its dividend by 82% to 3 cents per share. As always, keep in mind that the information should help you generate ideas, but there is more homework to be done, especially with stocks paying dividend yields above 7%.

Stocks with yields over 8% on the next page

Stocks yielding over 10%

Stocks yielding 8-10%

Stocks yielding 6-8%

Stocks yielding 6-8%

Stocks with yields between 4-6%

Stocks yielding 4-6%: