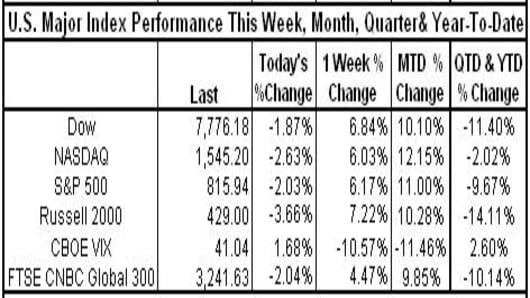

On a week dominated by the toxic asset plan, better-than-expected housing and durable goods data, the markets rally through their third straight week of gains. The last time all major indices rose for three consecutive weeks was the week ending May 2, 2008.

- The Dow and NASDAQ are on track for their best monthly gains since October 2002

- The S&P is on track for the best monthly gain since December 1991

- The NASDAQ 100 is now positive for 2009, up 3.29% YTD

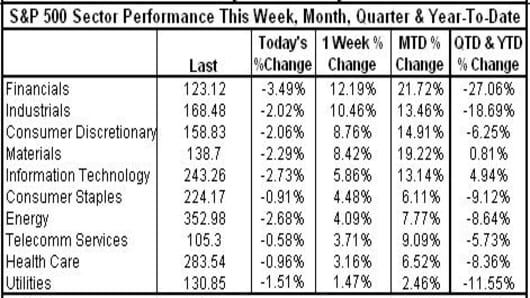

- Information Technology and Materials Sector are now both positive in 2009, up nearly 5% and 1% respectively

- Since the March 9th lows, the Dow is up 18.77%, the NASDAQ is up 21.80% and the S&P is up 20.61%