The Hong Kong property market has seen a spectacular rebound since the global financial crisis. Real estate prices in the territory have risen 50 percent since the end of 2008: 30 percent in 2009 and 15 percent this year, compounded.

But many are warning that the increase is unsustainable. HSBC's CEO for the Asia Pacific region, Peter Wong, cautioned in early August that Hong Kong could soon be facing a property bubble. Mark Matthews, an equity strategist at Macquarie, says the bubble is already here.

"If you had $3 million, would you buy one condominium on Conduit Road, Hong Kong, or five (properties) in Miami?" Matthews noted, drawing comparisons between the sizzling market in the territory and the plummeting property prices in the South Florida city.

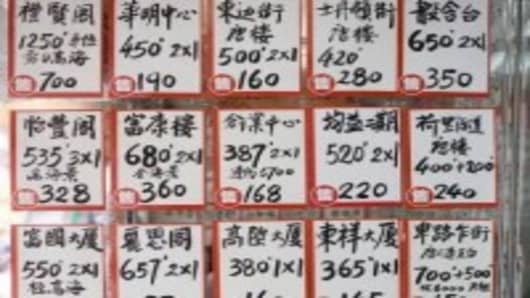

High-end property prices in Hong Kong have hit new highs and homes are now going for an average an $1,600 per square foot. Prices for Miami properties, on the other hand, have halved over the past three years to just $320 per square foot.

While comparing Miami 's real estate to Hong Kong 's may be a bit of a stretch, Matthews says it illustrates how outrageous prices have become in the territory. Hong Kong's residential value is now hovering at its all-time high, which translates to 320 percent of the territory's gross domestic product, according to research data from Morgan Stanley.

But the recent cooling measures announced by the Hong Kong government and China's move to hike rates may moderate prices somewhat, because Hong Kong's current property cycle, unlike those in the past, is driven almost solely by capital flowing from the mainland, according to Morgan Stanley's China strategist Jerry Lou.

"While the recent rate hike in China should not constrain the mainland's economic growth, we do expect it to start draining the liquidity overflow into Hong Kong's property market," Lou said. "The drying of liquidity would hurt property prices and also cap the performance of property stocks."

"China is not fighting inflation, China is fighting QE. What they're doing with the rate hike is to show the world that they're prepared to tighten, to stave off inflationary pressures from the Fed's easing moves," says Lou.

Still Beijing's move to quell inflation may not be enough to curb Hong Kong's property prices. According to Shane Oliver of AMP Capital Investors, countries that maintain fixed currency pegs to the U.S., like Hong Kong, will be importing the Fed's easy monetary policy for years to come. This is the ideal condition for the inflation of asset bubbles, he notes.

"I think we've got a long way to go yet over the next two-three years as these bubbles form and therefore it's incumbent upon investors, at least at this stage, to remain exposed to that and use any pullbacks to add to that exposure," says Oliver.

Mark Matthews says even if you add up the Fed's QE and the asset bubbles that it's creating - he would still want to ride the Hong Kong property market. His strategy to make money, without putting down too much money, is to invest in call options on the Hang Seng property index. "Call options on this index are relatively cheaper compared to those of large Hong Kong's property companies such as Cheung Kong or Sun Hung Kai Properties," says Matthews.