Russia is ready to develop substantial business interests beyond the oil and natural gas driven wealth that has been generated since the collapse of the Soviet Union, the head of investment bank UBS in the region told CNBC.

Around 40 percent of the Russian government’s tax take comes from tax on oil and gas-related businesses, and this is set to rise with plans to remove tax breaks on several big new oil fields and raise taxes on natural gas.

Some analysts have expressed concerns that Russia is overly reliant on its extensive natural resources.

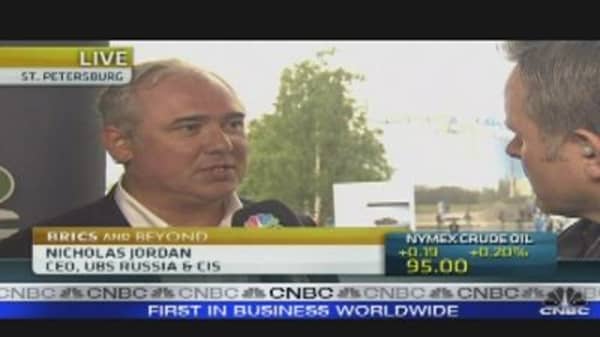

“There’s no question that the Russian government understands that they have got to diversify,” Nicholas Jordan chief executive of UBS Russia and CIS, told CNBC at the St Petersburg International Economic Forum (SPIEF) Thursday.

“The last several years have shown they are happy to do that. Russian growth is becoming more diverse: there’s more retail and consumer and other companies that have sprung up.

"Whether it will work, we will see,” he added. "I think there’s appetite to get industry started up again, but they realise that these days it’s not so easy and they need to find other things, such as technology."

Finding the capital to start new, non-oil and gas related businesses, could be a problem, according to Jordan.

"That’s something that this government needs to look at and do something about," he said. "I think that will start with some of the new statues on pension reform, on larger infrastructure, property rights and stability. I’m very optimistic these will happen.

“I don’t see political uncertainty” he said.

Russian President Dmitri Medvedev has announced plans to improve Moscow’s international reputation in an effort to turn the city into a greater financial centre, ahead of elections next year.

The measures are designed to increase transparency, enforce international accounting standards and give minority shareholders greater power.

Russian businessmen, including Rusal CEO Oleg Deripaska, have spoken out in favor of the plans.

Corporate governance issues have dogged Russian companies share prices around the world, Maxim Sokov, deputy to Deripaska at Rusal, told CNBC earlier this month.

"We are trying to work out what good corporate governance is," Sokov added. "The President announced recently laws which will change the legislative environment, especially for corporate governance, in the next 12 months."

Many Russian companies have chosen to list on stock exchanges outside the country, partly because of a perceived lack of institutional investors within Russia.

"Investment banking is improving," said Jordan.

"Pension reform has got to be made (for the IPO market to improve) but I now see that happening," he said.

Some recent London listings of Russian companies have struggled to get off the ground. HMS Hydraulic, the Russian pumps manufacturer, raised just 225 million pounds in February, below its original target of 407 million pounds. A planned float by Russian Helicopters was postponed, and steel pipe maker ChelPipe, which wanted to raise up to 430 million pounds, also delayed its IPO in February.