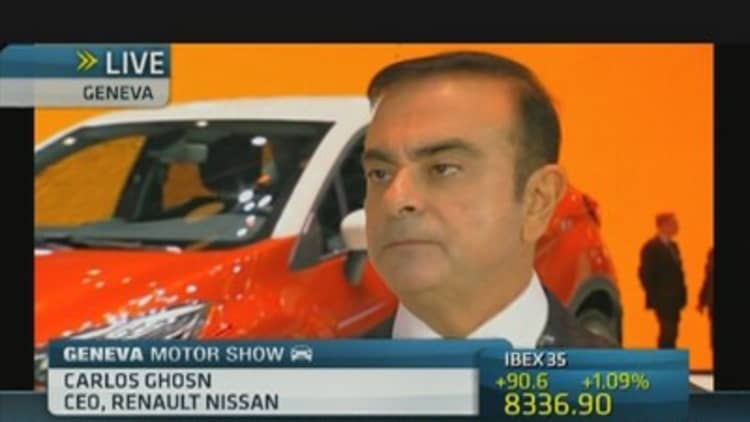

Europe's car market is facing a precipice and the region's shrinking demand shows little signs of recovery this year, Carlos Ghosn, CEO of Renault Nissan, the world's fourth-largest automaker, told CNBC Tuesday.

"The number one problem is that demand is shrinking and has shrunk by 8 percent in 2012 and continues to shrink in 2013. Capacity is a problem and competitiveness is a problem but these are of second and third magnitude in comparison to the fact that the total market is collapsing," Ghosn told CNBC.

Amid the glitz and glamour of the 83rd Geneva Motor show, carmakers were in unison about the problems facing Europe with some suggesting the gloom over the European market is here to stay.

The pessimism comes after German new car sales data showed a slump of more than 10 percent in February year-on-year. New car sales in Europe fell 8 percent in 2012 to a 17-year low.

Ford has felt the full force of the downturn, with its sales in Europe tumbling since the debt crisis took hold. Stephen Odell, CEO at Ford Europe admitted the market would continue to fall again this year.

"The way we count Western Europe we would expect it's down between 3 to 5 percent. So it's very tough and difficult," Odell told CNBC.

Odell said it would take a long time for European car sales to go back to the 17 to 18 million mark seen before the financial crisis.

"[It's] certainly outside of the 5-year horizon," he added.

Ford has rolled out a restructuring program and cost-cutting measures in the wake of the financial crisis, which involved the closure of key manufacturing plants in the U.K. and Belgium.

Even the CEO of luxury car maker Jaguar Land Rover (JLR) admitted sales in Europe were "challenging" and would remain so for "years tocome."

"Overall it's challenging especially in the south of Europe but there are some good opportunities in Eastern Europe and the U.K. is stable," Ralph Speth told CNBC.

Last year JLR, which is part of the Tata group and makes the Range Rover, increased sales by 30 percent and Speth said the start to the new year was "good…with [sales] up by another 30 percent."

He added it was the unique models and the specials designed specifically to customers' requirements that were seeing strong demand.

"We deliver extras and distinctive cars and special cars for special customers. These cars are in high demand and we've improved quality a lot which [puts us] in the top league," he said.

He dismissed rumors that JLR would consider moving production whole-scale move away from the U.K. insisting that the company was investing 500 million pounds ($756 million) in a new engineering center,doubling the number of U.K. jobs.

Audi's Board Member Luca de Meo said it was the markets outside of Europe that were giving the company sustenance.

"2013 looks like a tough year in Europe but we'll try to keep the market stable. We're holding the line and trying to nurture organic growth. The U.S. has grown by 50 percent in volume and China is a big source of sales and we believe [that] market will continue to grow," he said.