Despite optimism over the state of the global economy, chief financial officers from around the globe are becoming increasingly wary of asset valuations -- with some stating that they have held back on deals because of froth in markets.

More than 92 percent of respondents believe that U.S. stock valuations are high, according to a CNBC survey of 26 chief financial officers (CFO) from Europe and Asia who make up the CNBC CFO Council. Half of those CFOs who said their company was looking at acquisitions, admitted that they had completed the deal regardless of these valuations. About a third said valuations had been a deterrent.

The technology sector was a particular area of valuation concern, with more than 83 percent of those surveyed seeing valuations in the technology sector as being high, with over 8 percent believing that they are extremely high. Twitter's current price of around $40 since its initial public offering in November is also overvalued, according to 86 percent of respondents.

(Read More: Business confidence booms, hiring returns: Global CFO Council survey)

But despite this market froth, the CFOs remain convinced that the Nasdaq Composite is not in a bubble. The index has risen 33 percent so far this year with a current price-to-earnings ratio of 19.87. In late November, big-cap technology stocks helped the Nasdaq to finish above 4,000 points for the first time since the dot-com bubble burst in 2000. Almost two-thirds, 62 percent, of the CFO survey's respondents believe the Nasdaq is not in a bubble, compared with 38 percent who believe it is.

CNBC's survey showed finance chiefs have similar overvaluation concerns when it comes to virtual currencies. Bitcoin allows users to exchange online credits for goods and services. There's no central bank that issues them and they can be created online by using a computer to complete difficult tasks, a process known as mining. The price of bitcoin has topped $1,000 recently and whilst many advocates tout it as an alternative to fiat currency, our CFOs aren't as certain.

Over 85 percent of CFOs that responded see it as a "purely speculative" tool for investors trying to cash in, whereas around 14 percent considered it a "legitimate currency". Nearly 64 percent replied that they thought the digital currency was currently in an economic bubble.

The results reflect the concerns of several high-profile investors that years of central bank stimulus have made the markets too buoyant.

The U.S. Federal Reserve expanded its balance sheet soon after the global financial crash of 2008. It has since embarked on two more quantitative easing programs and is currently pumping an open-ended $85 billion-a-month into the U.S. economy. Meanwhile, the Bank of Japan and the Bank of England have both followed the Fed with asset purchases and low interest rates have been prevalent across the globe in an effort to combat deflation.

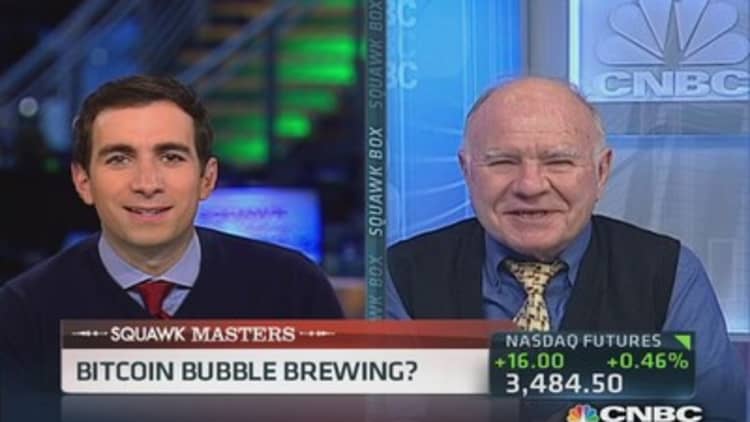

(Read More: Faber: 'We are in a massive speculative bubble')

With this increased liquidity, stocks have been one of the main beneficiaries. The is nearly 26 percent higher year-to-date and logged its longest weekly winning streak since 2004 on Friday.

Nomura strategist Bob Janjuah told CNBC on Tuesday that bond-buying by the Fed has essentially benefited the "owners of capital" and "people that can take leverage at the Fed window", failing to trickle down to the real economy.

(Read More: Holiday spending highlights US wealth gap: Nomura)

Marc Faber, editor and publisher of The Gloom, Boom & Doom Report, told CNBC on Friday he believes a "massive speculative bubble" has encroached on everything from stocks and bonds to alternative currency bitcoin and farmland. He attributed the vast bubble to "symptoms of excess liquidity."

— CNBC.com's Matt Clinch. Follow him on Twitter @mattclinch81