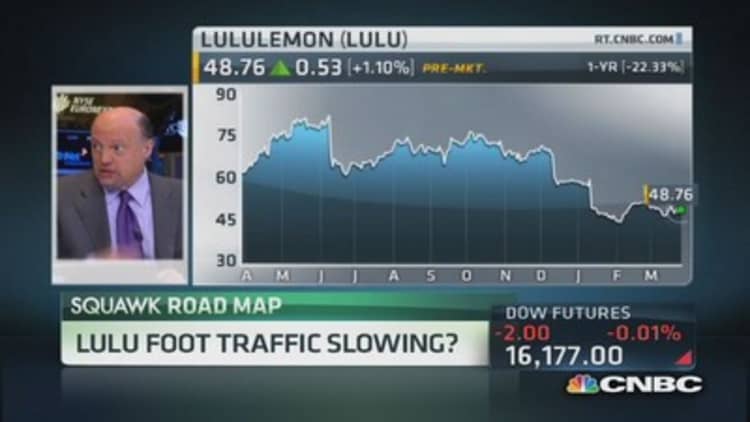

Lululemon Athletica forecast lower-than-expected first-quarter and full-year results on Thursday, as the Canadian yogawear retailer struggled to recover from a series of setbacks in 2013 after a high-profile and damaging product recall.

The retailer, which is facing increased competition, posted an almost flat year-on-year profit for the fourth quarter of 2013 and reported a decrease in comparable stores sales, its first such fall since 2009.

However, its overall results were marginally better than it had warned in January. Investors, also optimistic about Lululemon's long-term growth prospects, helped push its shares up more than 7.6 percent to C$51.90 in early trading.

"While the guide down was widely expected ... we're not sure that it will, or should, provide investors with much relief as Lulu has a lot going on this year, and the stock is not cheap based on the new guidance," wrote Faye Landes, an analyst at Cowen and Co.

The company forecast first-quarter profit of 31 cents to 33 cents per share on revenue of $377 million to $382 million and flat total combined comparable store sales.

Analysts, on average, had estimated first-quarter profit of 38 cents per share on revenue of $389.4 million, according to Thomson Reuters I/B/E/S.

For the 2014 fiscal year, Lululemon forecast profit of $1.80 to $1.90 per share on revenue of $1.77 billion to $1.82 billion, based on a total combined same-store sales increase in the low to mid-single digits in percentage terms.

Read More'Weather' true or not, winter excuse wearing thin

For the full year, analysts had forecast earnings of $2.14 a share and revenue of $1.82 billion.

"As we move into 2014, we are reflecting on our learnings with humility, and are entirely focused on our future," Laurent Potdevin, Lululemon's new chief executive, said in a statement.

"2014 is an investment year with an emphasis on strengthening our foundation, reigniting our product engine, and accelerating sustainable and controlled global expansion."

Potdevin's mission

Potdevin, who was most recently president of trendy footwear brand TOMS Shoes, is expected to lead the company into its next expansion phase.

This includes tackling the international market, growing its e-commerce business, while repairing Lululemon's image after it was damaged by the recall a year ago of its signature yoga pants that were deemed too see-through.

Later in the year, it acknowledged sales had been hurt by negative press about the product recall and after founder Chip Wilson said Lululemon products "just actually don't work" with some women's body shapes.

Meanwhile, rival workout gear makers such as Gap's Athleta brand are aiming to take a bite out of Lulu's market share with similar, but slightly more affordable products.

Potdevin took the helm in January following the surprise departure of Christine Day.

Day was lauded for driving the company's blistering growth and transition from a niche player into a major retail force. She was also credited for Lululemon's success in the United States, a market few Canadian retailers have cracked.

Comparable store sales decline

For the fourth quarter ended Feb. 2, Lululemon earned $109.7 million, or 75 cents per share, compared to $109.4 million, or 75 cents per share, a year earlier.

Analysts, on average, had expected 72 cents per share.

Read More 5 things retail earnings tell us about the rest of the year

Net revenue increased 7 percent to $521.0 million.

Overall, its fourth quarter results came in slightly higher than its January forecasts, when it cautioned investors that traffic and sales in January slowed "meaningfully."

Sales at established stores fell by 2 percent on a constant dollar basis in the quarter, the first such decline since 2009. Total comparable sales, including online, rose 4 percent.

During the fourth quarter, the company added seven new stores for a total of 254 stores internationally, including its standalone store for girls, Ivivva Athletica.

—By Reuters