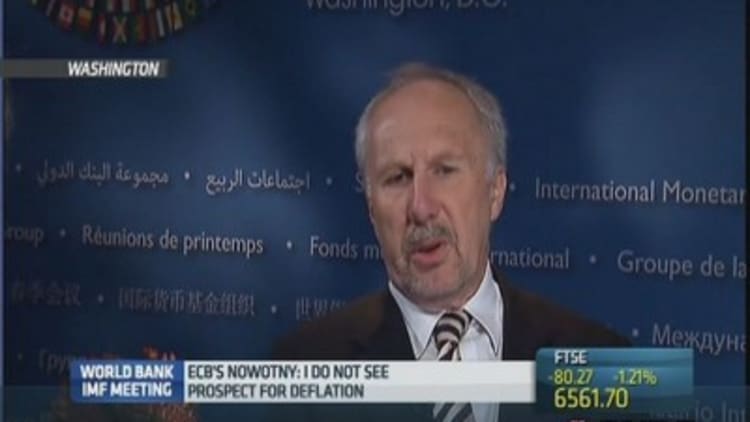

European Central Bank (ECB) policymaker Ewald Nowotny does not favor bond-buying to help the euro zone's recovery and argued the region wasn't under any threat of deflation.

This week, Nowotny, who serves on the ECB's governing council and is the president of the National Bank of Austria, was quoted as stating that there was no need for the central bank to counter low inflation, thus tempering investors' hopes of stimulus measures from the ECB.

Responding to this, Nowotny told CNBC: "I would not say in general that this is not the time for QE (quantitative easing). What I was saying is that I'm on the cautious side and what I prefer is that if we take measures, that these are measures that are as close to the market as possible, and so if there is certain lining-up I think then I would prefer something like asset-backed securities."

Read MoreBundesbank's Weidmann: Deflation risks are 'pretty limited'

There has been a war of words recently between the ECB and the International Monetary Fund (IMF) regarding the future course of European monetary policy. While there are signs of a recovery in the euro zone, IMF head Christine Lagarde called last week for more monetary easing by the ECB to combat falling inflation.

Lagarde said there was an emerging risk of what she called "low-flation," particularly in the euro area.

ECB President Mario Draghi took a swipe at the IMF's stance and defended the bank's decision to keep monetary policy and interest rates unchanged for another month.

Read MoreECB 'really concerned' on inflation: Vice-President

Draghi predicted a "prolonged period" of low inflation, and said the ECB was willing to consider further monetary easing.

Nowotny added Friday that he did not see "a perspective of deflation" but that policymakers still had to be cautious.

"I think that it makes sense to wait a bit really to see how things develop. There might be some perspective that inflation rates might increase in Europe," he said, arguing that there were certain signs that made him confident of a recovery on the continent.

"We see that the economic recovery might be stronger-than-expected. We see that in some important countries of Europe, like Germany, we might see an upwards revision of the growth perspective to about two percent...We see that wage increases in Germany and Austria will be about 3.5 percent. So there should be some elements increasing the inflation."