With the Dow hitting a new intraday record and the trading above its record close on Monday, fund manager Rich Weiss thinks the bullish case for equities is beginning to wane.

"Valuations seem to be getting a little toppy here," said Weiss, senior portfolio manager with American Century Investments. "We've ridden this bull market for the last several years and continue to be positioned fairly bullish—overweighting equities and other risk assets."

However, he called the valuation metrics "not anywhere near as compelling" as they were over the past few years.

Read MoreJim Paulsen: 'We're setting up for another run'

"The tenor of the bull is changing. And so we are seeing a rotation, and we are indeed rotating our positions from what's essentially a tug of war between mid-cycle stocks and some of the later defensive-oriented issues," Weiss told CNBC's "Power Lunch."

He's also defensively hedged when it comes to fixed income.

"We've been pulling back on durations more recently, taking on economic risk but shying away from interest rate risk given the probability if not likelihood of higher rates this year."

Read MoreStock market rally holds up; traders wonder why

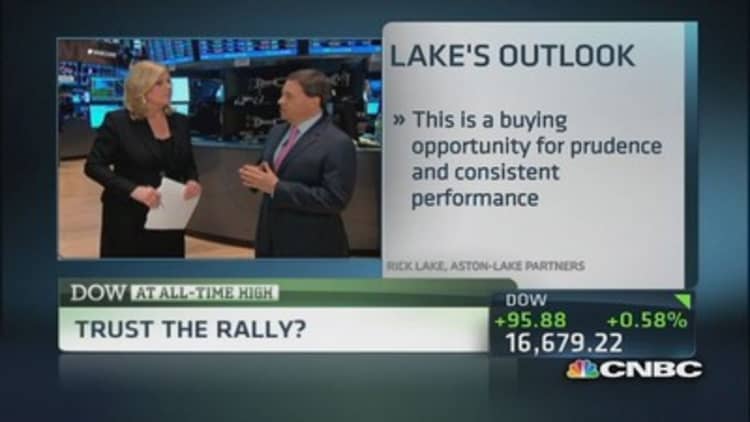

Rick Lake, a four-star portfolio manager with Aston/Lake Partners, said he has an emphasis on long-short equity strategies.

"Investors are moving back on the long side to companies with substance, companies with earnings growth, companies with dividend growth, and they've been tiptoeing away from some of those over-hyped hope stories that had ruled the market," he said.

Read MoreStock market will 'explode to the upside': Pro

Lake said he's looking at a couple of areas in fixed income, specifically focusing on long-short credit.

"There are some great opportunities on the distressed side, for example, but there's plenty of richly priced high-yield bonds, which are a source for hedging."

—By CNBC's Michelle Fox.