Whether or not the price of crude has hit bottom, oil stocks are still likely to appreciate over the next few months, Wolfe Research Managing Director Paul Sankey said Tuesday.

dropped below $80 a barrel, hitting two-year lows, with some analysts predicting that it could head toward $70 in next year due to oversupply.

"I think there's a good chance it's bottomed," Sankey said. "Certainly, seasonally this is a low, and we think it's a terrible time to capitulate and go negative. We're a month away from an OPEC meeting. We do think the Saudis may be trying to scare the other members of OPEC into making cuts with them, which is why the news flow has been so overwhelmingly bearish."

On CNBC's "Halftime Report," Sankey said that the hit to crude prices could be a boon for oil stocks.

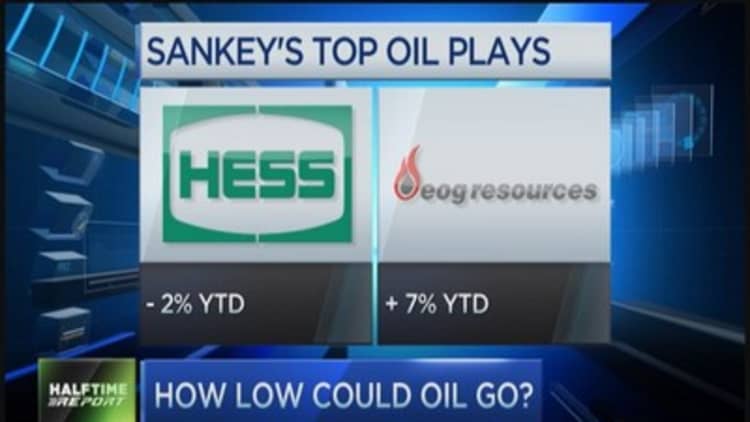

"Well, if we're right and oil's bottoming and going to go up, you could almost buy oil stock. And the more leverage the better, just because of the weak demand," he said. "We prefer buying quality, so a highlight name is EOG. We like restructuring and cash returned to shareholders, so we like Hess a lot here. And we like pure dividends, so you could buy a ConocoPhillips or look at European names."

Even if crude oil prices continue to drop, analysis of historical data from the previous six down cycles suggests that stocks could see an upward swing, Sankey added.

"If you had bought oil stocks 25 percent above the lows, you would've made money over the next six months," he said. "That was a pure quantitative analysis. It's not our view. It's actually just what happened in the market."

Read More Billionaire oilman: I'm not cutting production ... yet

Sankey said that equity markets are good at discounting what's going to happen next.

"If Brent rallies, we could see the spread rewidening, and that's actually what's discounted in futures markets right now. So, if you look at the futures strip for WTI and the futures strip for Brent, you'll see that they widen quite dramatically going forward, to the point where you would be buying refiners, absolutely," he said.

Sankey said that while there were concerns that shares of oil refiners would suffer on weak demand, "nevertheless, we've seen the stocks actually perform really well for such an aggressively negative energy tape."

Sankey also shared two of his top-rated stocks.

"We're putting a lot of hope in the new CEO at Valero, and for pure leverage we like Delek and Western Refining," he said.

Disclosure: Sankey does not hold positions in any of the stocks mentioned.