Asian bourses finished mixed on the last trading day of the week on the back of falling oil prices, and as investors turned cautious ahead of Monday's launch of the Shanghai-Hong Kong bourse linkup. Japan's gross domestic product for the third quarter due next Monday also added to the cautious sentiment.

Overnight, U.S. stocks fluctuated, with energy companies slammed as the price of oil fell, countering upbeat earnings from the world's largest retailer Wal-Mart and data showing jobless claims holding at a 14-year low.

Oil prices touched four-year lows early Friday after government data showed U.S. crude stockpiles surged at the delivery point for crude futures. Brent traded at $77.92 a barrel while U.S. crude fell $2.84 to $74.34 a barrel, a trough from September 2010.

Read MoreWhat Iran nuclear talks mean for the price of oil

Today's calendar

Malaysia's economy grew an annualized 5.6 percent in the July-September period, in line with expectations, according to government data released at noon. This is compared with 6.4 percent expansion in the preceding quarter.

Hong Kong's growth report card is due at 1630 SIN/HK. "We think China slowdown and the pro-democracy protests contributed to increased downside risk to growth, which undermines consensus forecast of acceleration in growth," wrote ING analysts in a note.

India's wholesale price inflation eased for a fifth straight month in October to 1.77 percent, its lowest level in more than five years, government data showed on Friday. The rise in the wholesale price index (WPI) compared with a 2.20percent year-on-year jump forecast by economists in a Reuters poll. InSeptember, wholesale prices rose 2.38 percent from a year ago.

Meanwhile, world leaders arrive ahead of this weekend's G20 summit in Brisbane, Australia.

Tokyo gains 0.6%

Japanese shares reversed losses in the final hour of trade to finish near a seven-year high of 17,520 attained in the morning session. The Nikkei 225 - in its fourth straight winning session - got a boost from the yen which breached the 116 handle and held near a seven-year low against the greenback.

Market movements for the week have also been supported by speculation that Prime Minister Shinzo Abe may delay a planned sales tax hike and call for snap elections. "Every whisper or street rumor coming out of Japan is still being treated as fact by the market. The belief that a snap election is coming continues to drive wild swings in the yen and local Japanese markets," IG market strategist Evan Lucas wrote in a note.

Read MoreJapan GDP in focus as market debates tax hike

Honda and Takata were in focus after the carmaker announced late Thursday that it would recall another 170,000 vehicles globally to replace air bag inflators made by the latter. Shares of the carmaker traded 2.6 percent higher.

The auto parts maker closed down 0.4 percent on news that it was the subject of a U.S. criminal investigation over defective air bags that have been linked to 5 deaths.

Financials were also in the limelight; Mizuho Financial advanced 0.4 percent while Mitsubishi UFJ reversed declines to gain 0.3 percent ahead of interim results due after markets closed.

Mainland shares mixed

China's Shanghai Composite index trimmed losses to close down 0.3 percent while Hong Kong equities added 0.3 percent, ahead of the "through train" program next Monday.

"The indexes are falling mainly due to profit-taking but I think despite becoming more wary, investors are not pulling away from the market," Li Zheming, analyst at Datong Securities told Reuters.

Read MoreUS luxury label Tory Burch undeterred by HK protests

Sydney up 0.2%

Australian shares eked out a modest gain to snap a four-day losing streak on Friday, as gains in the banking sector pare losses in the energy space. The key S&P ASX 200 index was holding just above Thursday's two-week low of 5,433.

National Australia Bank and Australia & New Zealand Bank rose 0.9 percent each.

Energy plays are in focus after an overnight plunge in oil prices. Santos shaved 1.6 percent while Oil Search doubled losses in the afternoon session to 2 percent. Woodside Petroleum also retreated nearly 2 percent.

Seoul drops 0.8%

South Korea's benchmark Kospi index suffered steep declines on Friday as Thursday's dismal data deluge from China - the country's largest trade partner - ignited risk-on sentiment among investors.

Blue-chip majors Hyundai Motor and Samsung Electronics plummeted nearly 1 percent each. SK Innovation, the country's largest oil refiner, slumped 2 percent on the back of declining oil prices.

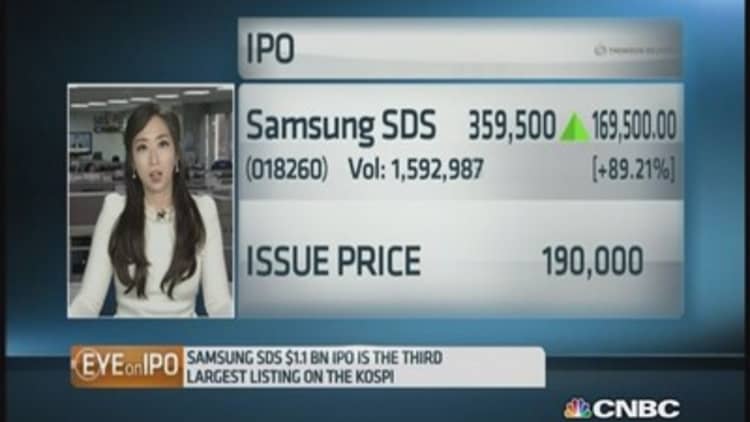

In focus was Samsung SDS, the IT services affiliate of the South Korean electronics conglomerate, which made its trade debut today. Its stock traded at 327,000 , nearly double of its initial offering price of 190,000 won, but slightly lower than the opening price of 380,000 won as profit-taking kicked in.

SDS - the fifth largest market capitalization on the South Korean bourse - is 19.05 percent owned by the three children of Samsung group patriarch Lee Kun-hee.