At a time when Venezuela is in dire need of financial backing, the country may be down to its last major banker: China. But even the economic powerhouse of Asia is closely weighing the risks of doing business with the struggling South American country.

So far, it seems China remains committed to the OPEC nation, at least according to Venezuela's President Nicolás Maduro, who announced in early January that China had pledged another $20 billion in financing.

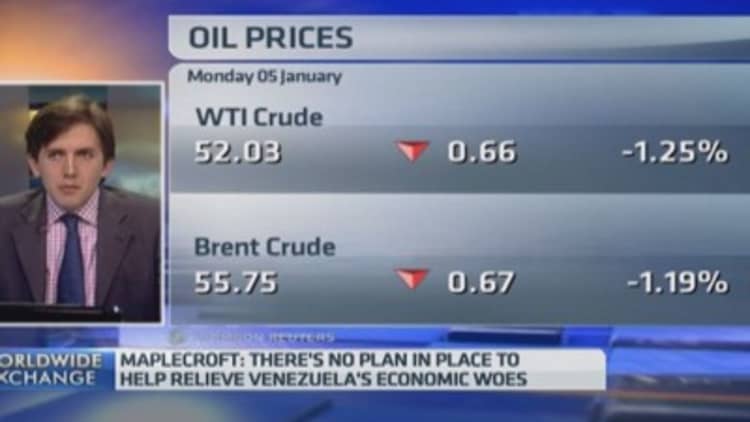

That's welcome news as oil prices continue to plummet with no bottom in sight. The going price of Venezuela's oil exports tumbled by about half to $41.33 a barrel this week after peaking last June, according to Venezuela's Ministry of Petroleum and Mining. In order to balance its budget, Venezuela needs oil prices of at least $100 a barrel, according to calculations from Barbara Kotschwar, research fellow at the Peterson Institute for International Economics.

Read MoreVenezuela's future? 'Barbarity and people looting'

Right now, low oil prices are shattering Venezuela's economy. The government in Caracas acknowledged in December that it's in recession. Venezuela's inflation rate, at 63.6 percent, is the highest in the Americas. Even the most basic consumer goods have ceased to be available, and visitors to the country who spoke to a CNBC reporter in neighboring Colombia this weekend reported people in Caracas using the local currency's smallest notes in place of toilet paper.

When a key revenue source falls so dramatically, then it's "almost inevitable that you seek financing to cover part of that gap," said Francisco Rodriguez, chief Andean economist at Bank of America.

Financing is "not necessarily bad policy" if China offers a reasonable interest rate, he said. "You want to be able to adjust to these declines in a gradual way. Oil will go back up to $60 or $70, but Venezuela will want to cut the spending that it did at $100. But you don't want to cut it to the level of $40."

Since 2007, China has lent Venezuela more than $45 billion, of which an estimated $30 billion has been paid back in oil shipments, according Rodriguez.

Last week, Moody's Investor Services cut Venezuela's credit rating by two levels down to Caa3, but China is still "cautiously willing to support," said Risa Grais-Targow, senior analyst for Venezuela at Eurasia Group, a political risk research firm, as long as it does not end up as a "lender of last resorts."

"China doesn't want to bail out Venezuela. If they did want to, they already would have," she said.

China shares the same concerns as any other investor in Venezuela, Rodriguez said. "The country has a set of economic policies that are about to run it into hyperinflation, massive levels of scarcity and effectively, a large economic crisis and contraction. That's not a country you want to lend to," he said.

In it for the long run

But as a long-term investor, China may "overlook more short-term blips" because it's already invested too much in Venezuela to watch the country "go belly up," said Kotschwar. "It's in China's interest for Venezuela to be functioning."

China is "playing a long-term game" in Venezuela, with an eye on its own future energy needs. Despite Venezuela's severe economic troubles, it still holds one of the world's largest unexploited oil reserves.

Read More Why Venezuela is so desperate, in 5 easy charts

Although China has already secured energy deals from Russia and African states, China wants to diversify its sources.

"The Chinese are very interested in having a country like Venezuela commit to sending a steady supply of oil to China every year," Rodriguez said. "So, think of financing as making an advanced purchase on oil."

China’s loyalty depends on Maduro

But China's future commitment to Venezuela depends on political stability, which in turn depends on how long Maduro can maintain his reign. Maduro's approval rating, at around 20 percent, is the lowest of a Venezuelan president since 1999, and polls forecast that his opponents will win parliament by a ratio of 2 to 1, Rodriguez said. Those elections are slated for late 2015, and the leader of the country's opposition coalition is calling for Venezuela to transform itself into "a Caribbean Norway."

"It's clear that current economic policies are not working, and I believe there are a lot of people in and out of the government who are aware and telling government to change. Either Maduro has to change policies or his government will be voted out of office," he said.

China doesn't want to bail out Venezuela. If they did want to, they already would have.Risa Grais-Targowsenior analyst for Venezuela, Eurasia Group

Brazil, another of Venezuela's few remaining supporters, has already started pulling back amid disappointment in Maduro's leadership.

The major question for Venezuela's leadership now is when and if China will come to a similar conclusion. China is likely concerned that following the regime change, the new government will not honor debt commitments.

For now, in order to secure their investment in Venezuela, Grais-Targow said, China is "leveraging something there. None of this money will be free. And Venezuela is digging themselves into a deeper hole, for sure."

How real is that $20 billion, anyway?

Further complicating Venezuela's outlook is that it's not entirely clear if the $20 billion agreed upon from China is entirely new financing, or whether it's earmarked for specific kinds of expenditures, Kotschwar warned.

"What Venezuela needs is liquid money, but we don't know if they are allowed to use the $20 billion to fill that gap from oil prices," she said. "The money may be repackaging of old loans, it may be just for infrastructure projects."

Read MoreIs Venezuela headed for a default?

"I'm skeptical that the $20 billion will follow through. I'm very cautious that that's the case," Rodriguez agreed. "Especially without more details from the Chinese side, we just have one vague statement from Maduro. It's possible that that statement is not aligned with any major new financing."

Neither country is known for transparency, and it's difficult to determine whether the $20 billion is an indication of China's continued support or a sign of China's tightening its purse, said Grais-Targow.

—With reporting by CNBC's Ted Kemp.