China's central bank increased its economic stimulus measures even further Wednesday amid growing concerns about the rate of expansion in the world's second-largest economy.

The People's Bank of China (PBOC) decided to cut banks' reserve requirement ratio (RRR) by 50 basis points to 19.5 percent. The move, effective Thursday, is the first such cut since May 2012. This will lower the amount of deposits that each lender is required to hold as reserves.

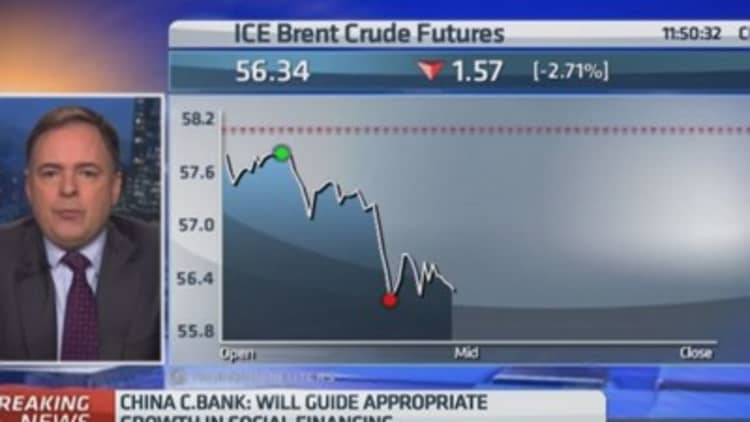

The measure will help keep the economy stable, the PBOC said alongside the decision which was announced around 10:30 a.m. GMT. It added that it will also help guide the appropriate growth in social financing.

Asian markets were closed during the announcement but their European counterparts received a boost on the news. Mining stocks like Fresnillo, which have a heavy exposure to China, rallied on the announcement as did Asian exposed lenders like Standard Chartered.

and New Zealand, whose economies are heavily reliant on the Chinese economy, saw their currencies lift on the news.

The PBOC's move follows on from a cut to one-year benchmark lending rates in November. Analysts at the time believed that such moves are motivated by a dovish central bank trying to cushion its fall from years of double-digit growth.

Data published last month revealed that China's economy grew at its slowest pace in 24 years in 2014, undershooting the government's target for the first time since 1998. Gross domestic product (GDP) expanded 7.4 percent from 7.7 percent in 2013. Government targets have been for a print of "around 7.5 percent."

Meanwhile, China's services sector grew at the slowest pace in six months in January as growth in new business weakened, an HSBC services purchasing manager's index (PMI) showed Wednesday, Reuters reported.

The slowdown comes at a time when the country's new leadership is stepping up regulation, curbing an overheated credit market and switching an export-focused economy into a consumer-driven one.

However, Larry McDonald, the senior director at Newedge USA, told CNBC Wednesday that the new announcement does mark a change in direction from the bank, compared to its strategy at this point last year. He explained that the PBOC had been more worried about the country's credit markets and had tried to curtail risk, but were now appearing to be more dovish.

"They have completely reversed course," he said. "It's a sign of global central bank panic," he added, with other central banks also producing similar moves in the last few months in the face of global deflation and growth downgrades from organizations like the World Bank.

In January, Chinese Premier Li Keqiang told an audience at the World Economic Forum in Davos that the economy was not heading for a hard landing and would instead stick to its current path of reforms and create far-reaching opportunities for the whole world.

He said that the Chinese economy had now entered a "new normal" where development is moving to a "medium-to-high" level. Likening the Chinese economy to a train, he added that the train would "not lose speed or momentum" and will be powered with a stronger motor going forward.

- By CNBC's Katrina Bishop and Matt Clinch. Li Anne Wong also contributed to this report.