Hold the front page! There is a new alien concept in financial markets – two-way trading in European bonds.

The tree is finally being well and truly shaken and who'd have thought that it would be good old boring German Government paper, Bunds to you and me, that are upsetting the herd the most?

The complacency that had afflicted the markets since the start of global quantitative easing (QE) –but more recently on the back of the European Central Bank's very own massive bond-buying program – has been unnerving for those of us who prefer two-way trading. You remember that: It was when there was actually a risk that putting on a trade, when there was no central bank backstop to get you out of jail.

Just to remind the younger traders out there, we used to talk mythically about the "Plunge Protection Squad" coming into the market to support assets at times of crisis. Nowadays it's nothing so clandestine, it's just: "Oh yeah, the central bank is in buying again". "Oh cool, keep on buying then".

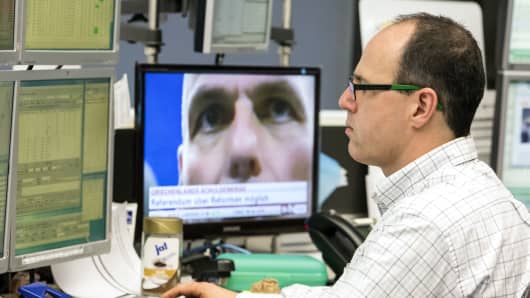

Back to the Bund story. Ever since ECB President Mario Draghi first told the markets in 2012 that he'd do "whatever it takes," and then later on laid out his plans for sovereign bond purchases, the market "front-ran" him and bought up every bit of quality – and quite a bit of non-quality – paper in sight in European fixed income.

Read More German Bunds suffer a rocky Friday but stay off 0%

Bunds were automatically top of the list of buys and, seeing as it was a free, one-way, trade which would only run out of steam when yields got to minus 0.2% and then there was still plenty of steam left in the trade at 0% yield (give or take the change), right? Well, apparently not.

Even though Draghi is apparently still a willing buyer until September next year, it appears the bulls forgot to look at a whole host of fundamentals. Factors that include the prospects of rising inflation expectations and the not inconsiderable fact that liquidity has been sapped out of the market, meaning that when it turned, it turned doubly hard. This has left us in the delicious situation where no-one it seems can trade their way out of a bad position and with the option to either stick it out or throw in the towel.

There is no one reason why the Bund turned so aggressively, but here are my top 10 contributing factors in no particular order:-

- 1.Complacency. As said, over-reliance on one ultimate buyer, in this case the ECB and Mario Draghi.

- Fixed Income exchange traded fund flows exacerbated the bull run. When these turned, there was no bid anywhere.

- On liquidity, global regulation has taken out the "prop desks" and other shock absorbers of flow. No middle-man means no cushion for market.

- Option traders again all placed long delta bets. Premium was low but no-one bought protection. Implied volumes had been at eight-year lows but no-one cared. No put protection means no natural buyers on the Bund dip.

- To underline the point above, look at Bill Gross. He said Bunds were a lifetime short but was apparently short premium NOT underlying bunds. Ouch!

- Technicals. Sixteen-month long-term channel support broke last Thursday. Once this was breached, gaps opened up left, right and center.

- Inflation! The oil price has had a great fat rally off the mid-$40s lows. This is set to have a major effect on euro zone inflation expectations. Inflation up and zero-yielding Bunds are not a good mix. Something had to give.

- It seems the collective amnesia also extended to the recent euro zone data. Not great, but it's been way more stable with the lower euro benefitting. Better data once again now leading to longer-term monetary tightening expectations.

- Even if you don't believe the better euro zone economic story, then surely you can't ignore Greece completely? Things are still dreadful there and contagion risks have not been priced in at all with its biggest European creditor's paper.

- Alternatives? No not solar or wind. I mean with Apple and others issuing shedloads of debt, there is a lot more fixed income choice out there for credit investors.

Did I say just 10? I may squeeze in one more.

11.The Great Rotation! Remember that one? It was all about the generational shift out of bonds into equities…it's been knocking around a couple of years now and hasn't worked to date but maybe this is just the start of it.