Biggest biotech IPO ever. Biotech firm Axovant priced 21 million shares at $15 on the NYSE, the high end of the price talk of $13-$15. That's $315 million, which makes it the largest biotech IPO ever based on the amount raised, according to Renaissance Capital.

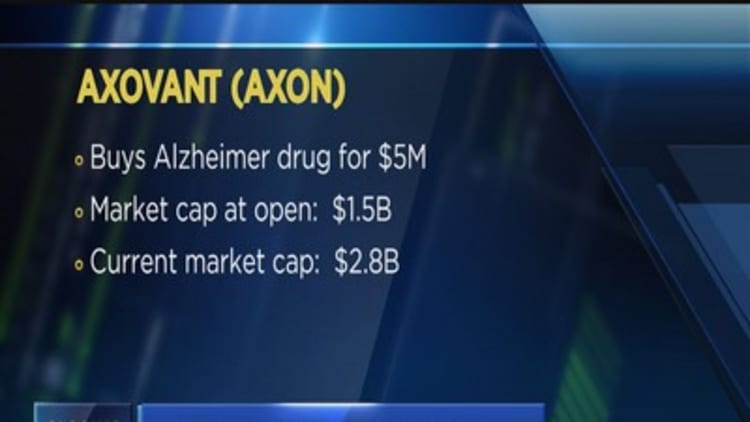

But that's only part of the story. Those 21 million shares are only a fraction of the 100 million shares the company has. So the market capitalization of the company at the open was $1.5 billion ($100 million x $15 a share).

The stock closed at $29.90, up almost 100 percent. So we are now dealing with a market capitalization approaching $3 billion.

Here's what's remarkable: The company has only one product, a dementia drug for treating Alzheimer's.

This drug is entering Phase 3 trials.

The CEO, Vivek Ramaswamy, bought this drug from Glaxo for $5 million (Glaxo will get contingent payments if the drug gets approved).

This is rather remarkable. Ramaswamy buys a drug Glaxo passes on for $5 million, turns around and raised $315 million in an IPO, and now has a company that is worth almost $3 billion.

Does this amaze you? It amazes me. Either 1) Ramaswamy has made one of the great investments of all time and Glaxo has made a serious error passing on the drug, or 2) the company is overvalued. Very.

Part of this, of course, is due to the nature of the investment: 1) biotech is a hot space, and 2) there is a serious paucity of effective treatment modalities for Alzheimer's.

It raises another question: Is biotech developing into a bubble?

Let's try to narrow the definition. How about looking for really big first-day pops in biotech IPOs. That's a sign of investment mania.

This was one of the tells in the dot.com implosion. In 1999-2000, average first-day pops were roughly 50 percent to 70 percent, according to Renaissance. So investors didn't do much research; they just went in on every deal because everyone believed in that immediate pop.

Are we seeing this in biotech? Over the last year, there have been 61 biotech IPOs; the first-day pop for the larger deals (over $100 million) has been 38 percent. That's a lot given how conservative the IPO market has been.

Here are a few first-day pops for biotechs in the last year:

Aduro Biotech up 147 percent

Sparks Therapeutics up 117 percent

Axovant up 99 percent

Avalanche Biotech up 64 percent

Tokai Pharmaceuticals up 58 percent

So, are we in a biotech bubble? There are a few that have had big pops, but most are larger companies. If you compare the entire universe of biotech IPOs (all 61), the average first-day pop has been only 10.2 percent. That's about in line with the average first-day pop of the entire IPO universe: 12.5 percent.

Bottom line: There are a few signs of a bubble on the larger biotechs. Why? One possible reason is that investors have a hard time judging the science, and many are likely using size as a factor. Stay tuned.