The Fed's monetary policy statement on Wednesday afternoon won't come with a press conference. Those Q&A sessions with the Fed chair happen in alternating meetings, so the next press conference will happen in September.

But if you're feeling lost without Fed Chair Janet Yellen live on camera, in what could be the last meeting before the Fed raises rates for the first time in nearly a decade, don't forget that Yellen has issued more than 25,000 words worth of Federal Open Market Committee press statements that might be worth a read. Market participants and financial journalists already obsess over every little word in the Fed's statements, so we broke down every single word Yellen has ever said in her official policy meeting interviews as well.

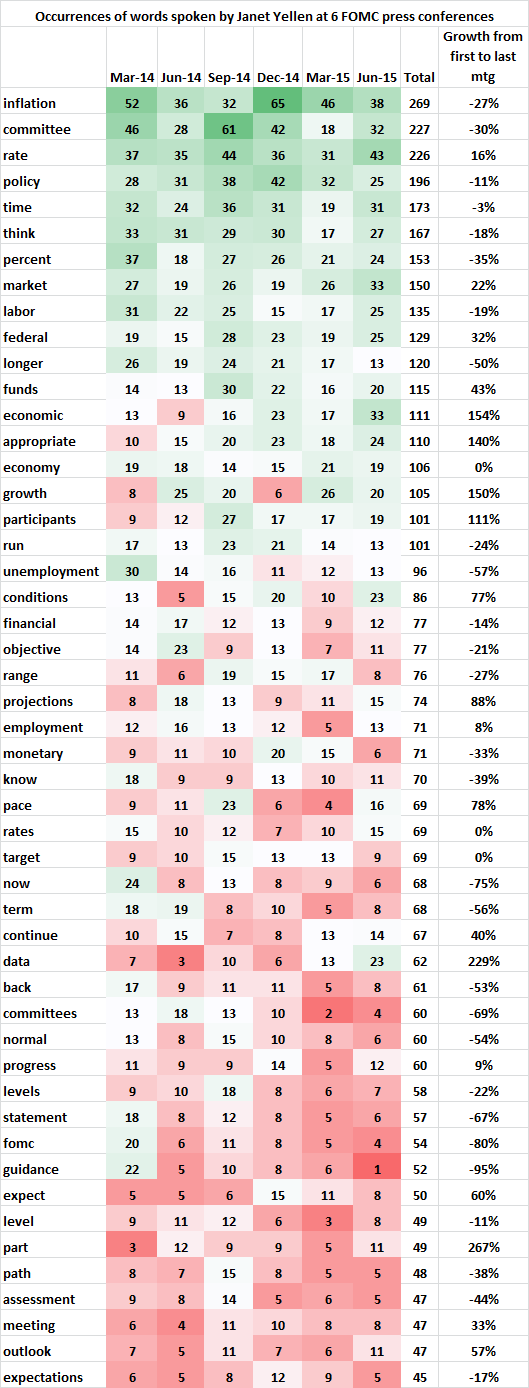

Specifically, we looked at every one of Yellen's statements and answers to questions in the six FOMC press conferences since she became chair in February 2014. (The questions themselves are excluded, along with a variety of common words—like "the," "so" and "it.")

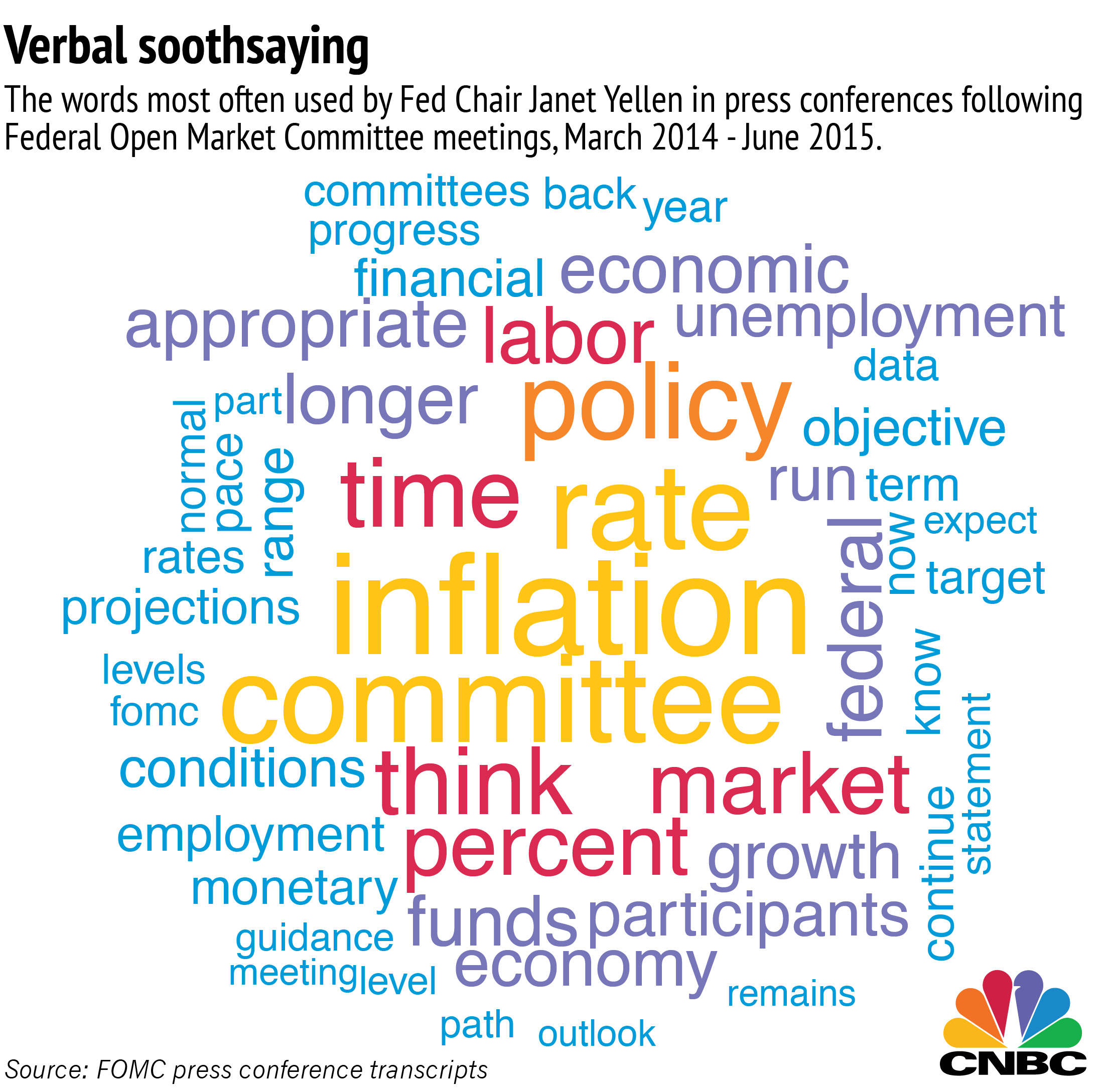

Here are the most frequently spoken words by Yellen in total among her six press conferences.